Urbanization and Population Growth

Urbanization and population growth are key factors influencing the Electric Bus Charging Infrastructure Market. As more people migrate to urban areas, the demand for efficient public transportation systems increases. Electric buses are becoming a preferred choice for many cities aiming to modernize their transit systems while addressing environmental concerns. The United Nations projects that by 2030, nearly 60% of the world's population will live in urban areas, which could lead to a significant rise in electric bus usage. Consequently, this demographic shift necessitates the expansion of charging infrastructure to support the growing fleet of electric buses, presenting a lucrative opportunity for market participants.

Government Initiatives and Regulations

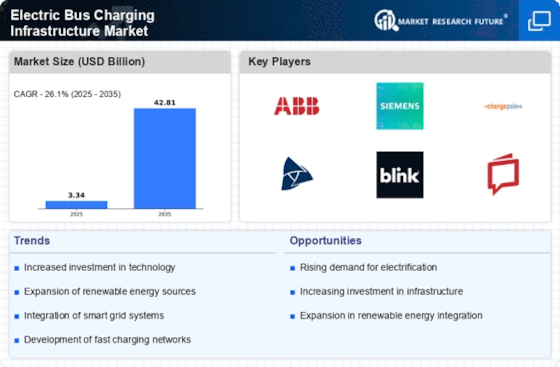

Government initiatives and regulations play a pivotal role in shaping the Electric Bus Charging Infrastructure Market. Many governments are implementing stringent emissions regulations and offering incentives for electric vehicle adoption, which includes electric buses. For instance, policies that mandate a certain percentage of public transport to be electric can drive the demand for charging infrastructure. In 2025, it is estimated that investments in electric bus charging infrastructure could reach several billion dollars, as municipalities seek to comply with these regulations. This regulatory environment not only encourages the deployment of charging stations but also fosters innovation in charging technologies, thereby enhancing the overall market landscape.

Investment in Renewable Energy Sources

Investment in renewable energy sources is increasingly influencing the Electric Bus Charging Infrastructure Market. As the world shifts towards sustainable energy solutions, the integration of renewable energy into charging infrastructure becomes essential. Electric bus charging stations powered by solar or wind energy not only reduce operational costs but also enhance the sustainability of public transport systems. In 2025, it is expected that a considerable portion of new charging stations will incorporate renewable energy technologies, driven by both environmental policies and economic incentives. This trend not only supports the growth of the electric bus market but also aligns with broader goals of reducing greenhouse gas emissions.

Rising Demand for Sustainable Public Transport

The increasing demand for sustainable public transport solutions is a significant driver of the Electric Bus Charging Infrastructure Market. As urban populations grow, cities are under pressure to reduce their carbon footprints and improve air quality. Electric buses are seen as a viable solution to these challenges, leading to a surge in their adoption. According to recent data, the number of electric buses in operation is projected to double by 2027, necessitating a corresponding expansion in charging infrastructure. This trend indicates a robust market opportunity for stakeholders involved in the development and deployment of charging solutions, as cities invest in cleaner transportation options.

Technological Innovations in Charging Technologies

Technological innovations are transforming the Electric Bus Charging Infrastructure Market, making charging faster, more efficient, and more accessible. Developments such as ultra-fast charging stations and wireless charging systems are emerging, which could significantly reduce downtime for electric buses. The introduction of smart charging solutions, which optimize energy use based on demand and grid conditions, is also gaining traction. By 2025, it is anticipated that the market for advanced charging technologies will grow substantially, driven by the need for efficient energy management and the integration of renewable energy sources. This technological evolution is likely to enhance the attractiveness of electric buses and their associated charging infrastructure.