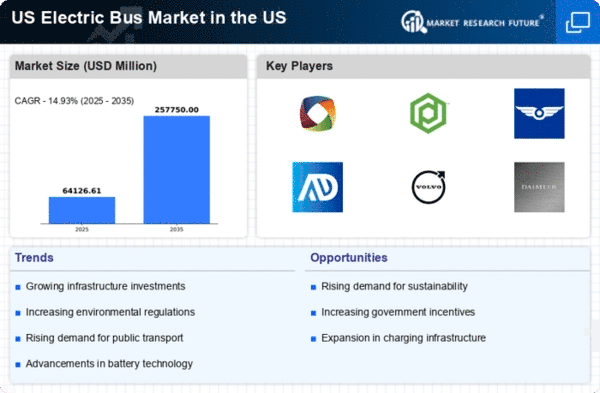

Advancements in Charging Infrastructure

The automotive electric-bus market is benefiting from advancements in charging infrastructure, which are crucial for the widespread adoption of electric buses. The development of fast-charging stations and improved battery technology has made it feasible for transit agencies to integrate electric buses into their fleets. As of 2025, the US has seen a significant increase in the number of charging stations, with estimates suggesting a growth of over 30% in the past two years. This expansion of charging infrastructure not only alleviates range anxiety for operators but also enhances the operational efficiency of electric buses. Consequently, the automotive electric-bus market is likely to experience accelerated growth as transit agencies invest in electric fleets supported by robust charging networks.

Cost Savings and Total Cost of Ownership

The automotive electric-bus market is increasingly attractive due to the potential for cost savings and a lower total cost of ownership (TCO) compared to traditional diesel buses. Electric buses typically have lower fuel and maintenance costs, which can lead to substantial savings over their operational lifespan. Recent analyses indicate that transit agencies can save up to 30% on fuel costs and experience reduced maintenance expenses due to fewer moving parts in electric drivetrains. As transit authorities seek to optimize their budgets, the financial advantages of electric buses become a compelling driver for market growth. This trend suggests that the automotive electric-bus market will continue to expand as more agencies recognize the long-term economic benefits of transitioning to electric fleets.

Increasing Urbanization and Population Density

The automotive electric-bus market is experiencing a surge in demand due to increasing urbanization and population density in major cities across the US. As urban areas expand, the need for efficient public transportation solutions becomes more pressing. Electric buses offer a sustainable alternative to traditional diesel buses, reducing emissions and improving air quality. According to recent data, urban populations are projected to grow by approximately 10% by 2030, leading to a higher demand for public transit options. This trend is likely to drive investments in electric bus infrastructure, as municipalities seek to modernize their fleets and meet the needs of their growing populations. Consequently, the automotive electric-bus market is positioned to benefit from this urban shift, as cities prioritize cleaner and more efficient transportation solutions.

Environmental Regulations and Emission Standards

The automotive electric-bus market is significantly influenced by stringent environmental regulations and emission standards imposed by federal and state governments. These regulations aim to reduce greenhouse gas emissions and improve air quality, particularly in urban areas. The US Environmental Protection Agency (EPA) has set ambitious targets for reducing emissions from public transportation, which has prompted transit authorities to transition to electric buses. As of 2025, many states are expected to implement stricter emission standards, further incentivizing the adoption of electric buses. This regulatory landscape creates a favorable environment for the automotive electric-bus market, as transit agencies seek to comply with these regulations while also addressing public concerns about climate change and air pollution.

Public-Private Partnerships and Funding Opportunities

The automotive electric-bus market is being propelled by the emergence of public-private partnerships (PPPs) and various funding opportunities aimed at promoting sustainable transportation solutions. These collaborations between government entities and private companies facilitate the development and deployment of electric bus technologies. In 2025, several states have initiated funding programs to support the acquisition of electric buses, with grants and incentives available for transit agencies. This financial support is crucial for overcoming the initial capital costs associated with electric bus procurement. As a result, the automotive electric-bus market is likely to see increased participation from both public and private sectors, fostering innovation and accelerating the transition to electric public transportation.