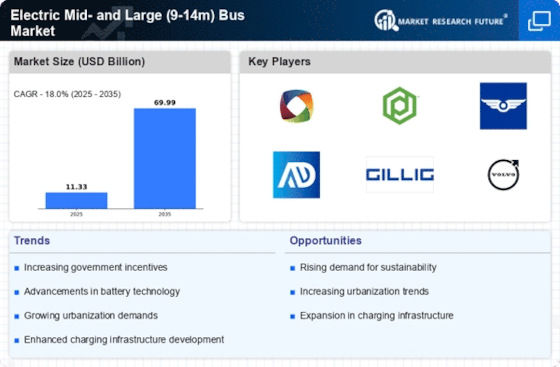

Increasing Environmental Awareness

The Electric Mid- and Large (9-14m) Bus Market is benefiting from a growing awareness of environmental issues among the public and policymakers. As concerns about air quality and climate change intensify, there is a strong push for cleaner public transport solutions. Electric buses produce zero tailpipe emissions, making them an attractive option for cities aiming to reduce their carbon footprint. This shift in public sentiment is prompting transit authorities to prioritize electric bus procurement in their fleet modernization plans. Moreover, studies indicate that electric buses can reduce greenhouse gas emissions by up to 70% compared to diesel counterparts. Consequently, the Electric Mid- and Large (9-14m) Bus Market is likely to expand as cities strive to meet sustainability goals.

Urbanization and Public Transport Demand

Rapid urbanization is significantly influencing the Electric Mid- and Large (9-14m) Bus Market. As populations in urban areas continue to grow, the demand for efficient and reliable public transport systems is escalating. Electric buses are increasingly viewed as a viable solution to address the challenges of urban mobility. They offer the potential for reduced operational costs and improved service reliability, which are essential in densely populated areas. Furthermore, the integration of electric buses into public transport networks can enhance the overall passenger experience by providing quieter and more comfortable rides. This trend suggests that the Electric Mid- and Large (9-14m) Bus Market will likely see sustained growth as cities adapt to the needs of their expanding populations.

Government Incentives and Support Programs

Government incentives play a pivotal role in shaping the Electric Mid- and Large (9-14m) Bus Market. Various countries are implementing financial incentives, such as grants and tax credits, to encourage the adoption of electric buses. For example, funding programs aimed at reducing the upfront costs of electric buses can significantly influence purchasing decisions by transit agencies. Furthermore, regulatory frameworks mandating emissions reductions are pushing public transport operators to transition to electric fleets. In some regions, governments are setting ambitious targets for electric vehicle adoption, which directly impacts the growth trajectory of the Electric Mid- and Large (9-14m) Bus Market. This supportive environment fosters investment and innovation, ultimately leading to a more robust market.

Infrastructure Development and Charging Solutions

The development of charging infrastructure is a critical driver for the Electric Mid- and Large (9-14m) Bus Market. As electric buses become more prevalent, the need for reliable and accessible charging solutions is paramount. Investments in charging stations, particularly in urban centers and along major transit routes, are essential to support the operational needs of electric bus fleets. Additionally, advancements in fast-charging technologies are enabling quicker turnaround times for buses, thereby enhancing operational efficiency. The establishment of a robust charging network not only facilitates the adoption of electric buses but also reassures transit operators regarding the feasibility of transitioning to electric fleets. Consequently, the Electric Mid- and Large (9-14m) Bus Market is poised for growth as infrastructure continues to evolve.

Technological Advancements in Electric Bus Design

The Electric Mid- and Large (9-14m) Bus Market is experiencing a surge in technological advancements, particularly in battery systems and electric drivetrains. Innovations such as solid-state batteries and improved energy density are enhancing the performance and range of electric buses. For instance, the latest models can achieve ranges exceeding 300 kilometers on a single charge, which is crucial for urban transit systems. Additionally, advancements in lightweight materials and aerodynamics are contributing to increased efficiency. These developments not only improve operational efficiency but also reduce total cost of ownership, making electric buses more appealing to transit authorities. As technology continues to evolve, the Electric Mid- and Large (9-14m) Bus Market is likely to see a shift towards more sustainable and efficient public transport solutions.