North America : Innovation and Sustainability Focus

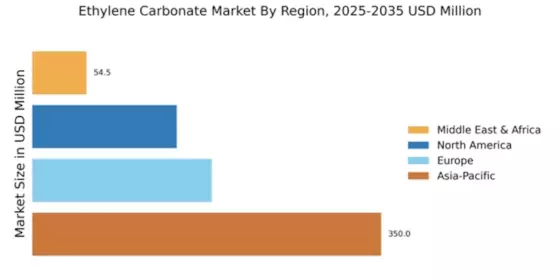

The North American Ethylene Carbonate market is projected to reach $145.0 million by 2025, driven by increasing demand in battery applications and sustainable solutions. Regulatory support for green chemistry and eco-friendly products is enhancing market growth. The region's focus on innovation, particularly in electric vehicle (EV) batteries, is a significant growth driver, as manufacturers seek high-performance electrolytes that meet stringent environmental standards. Leading countries in this region include the US and Canada, where major players like Huntsman Corporation and Eastman Chemical Company are actively investing in R&D. The competitive landscape is characterized by a mix of established companies and emerging startups, all vying for market share. The presence of key players ensures a robust supply chain, facilitating the growth of the Ethylene Carbonate market in North America.

Europe : Regulatory Support and Innovation

Europe's Ethylene Carbonate market is expected to grow significantly, reaching €180.0 million by 2025. The region benefits from strong regulatory frameworks promoting sustainable chemicals and renewable energy sources. The European Union's Green Deal and REACH regulations are pivotal in driving demand for eco-friendly materials, particularly in the automotive and electronics sectors, where Ethylene Carbonate is increasingly utilized as a solvent and electrolyte. Germany, France, and the UK are leading countries in this market, with key players like BASF SE and Solvay S.A. spearheading innovation. The competitive landscape is marked by collaborations between chemical manufacturers and technology firms, enhancing product offerings. The presence of established companies ensures a stable supply chain, while ongoing investments in R&D are expected to further boost market growth in Europe.

Asia-Pacific : Dominant Market Leader

The Asia-Pacific region dominates the Ethylene Carbonate market, with a projected size of $350.0 million by 2025. This growth is fueled by rapid industrialization, increasing demand for electric vehicles, and a shift towards sustainable materials. Countries like China and Japan are at the forefront, with government initiatives supporting the development of green technologies and battery production, which are critical for the region's market expansion. China is the largest market, hosting key players such as Shenzhen Capchem Technology Co., Ltd. and Tianjin Cangzhou Dahua Group Co., Ltd. The competitive landscape is vibrant, with numerous local and international companies vying for market share. The presence of established manufacturers and ongoing investments in innovation are expected to sustain the region's leadership in the Ethylene Carbonate market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) Ethylene Carbonate market is projected to reach $54.46 million by 2025, driven by increasing industrial applications and a growing focus on sustainable solutions. The region's economic diversification efforts and investments in renewable energy are catalyzing demand for Ethylene Carbonate, particularly in battery manufacturing and electronics. Regulatory frameworks are gradually evolving to support green chemistry initiatives, enhancing market prospects. Leading countries in this region include South Africa and the UAE, where local manufacturers are beginning to establish a foothold in the market. The competitive landscape is still developing, with opportunities for both local and international players. As the region continues to invest in infrastructure and technology, the Ethylene Carbonate market is expected to witness significant growth in the coming years.