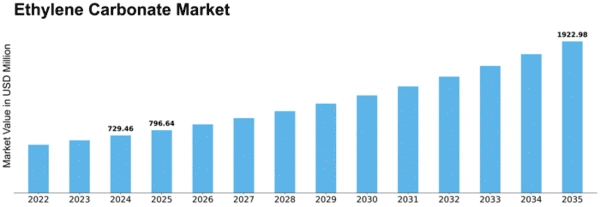

Ethylene Carbonate Size

Ethylene Carbonate Market Growth Projections and Opportunities

The Ethylene Carbonate market is influenced by several key factors that shape its dynamics and growth trajectory. One of the primary drivers is the increasing demand for lithium-ion batteries, which are extensively used in electronic devices, electric vehicles, and energy storage systems. Ethylene carbonate serves as a crucial component in the electrolyte formulation for these batteries, driving its demand in tandem with the growth of the battery industry. Additionally, the expanding automotive sector, particularly the rise in electric vehicle production, further propels the demand for ethylene carbonate as it is used in electrolytes for lithium-ion batteries, enhancing their performance and safety.

Generally, ethylene carbonate does not have colour in nature, but it is moderately yellowish solid in appearance with a distinct odor. It has a solvent character with higher polarity, high boiling point, high solubility for polymers and no odor. The use of ethylene carbonate is increasing nowadays as it provides low toxicity in nature.

Furthermore, regulatory initiatives and environmental concerns play a significant role in shaping the ethylene carbonate market. Stringent regulations aimed at reducing emissions and promoting eco-friendly alternatives have led to a growing preference for greener chemicals and materials, including bio-based ethylene carbonate. Manufacturers are increasingly focusing on developing sustainable production methods and sourcing renewable feedstocks to align with these regulations and meet consumer demands for environmentally friendly products.

Global economic conditions and geopolitical factors also exert a notable influence on the ethylene carbonate market. Economic growth, industrial output, and trade policies impact the overall demand and supply dynamics of chemicals, including ethylene carbonate. Fluctuations in currency exchange rates, trade tariffs, and geopolitical tensions can disrupt supply chains, affect raw material prices, and influence market competitiveness, thereby affecting the growth trajectory of the ethylene carbonate market.

Technological advancements and innovations are driving significant developments in the ethylene carbonate market. Ongoing research and development efforts focus on improving the efficiency, performance, and sustainability of ethylene carbonate-based products. Novel manufacturing processes, catalyst technologies, and formulation techniques are being explored to enhance product quality, reduce production costs, and minimize environmental impact. Additionally, advancements in material science are leading to the development of new applications for ethylene carbonate beyond its traditional uses, further expanding market opportunities.

The competitive landscape and industry structure also shape the dynamics of the ethylene carbonate market. The market is characterized by the presence of several key players, including multinational corporations, regional manufacturers, and small to medium-sized enterprises. Intense competition, pricing pressures, and strategic collaborations influence market consolidation, product differentiation, and innovation. Companies are increasingly focusing on expanding their production capacities, investing in research and development, and exploring new market segments to maintain their competitive edge and capture a larger market share.

Moreover, consumer preferences and end-user industries' requirements play a pivotal role in driving market demand and product development in the ethylene carbonate market. End-use sectors such as electronics, automotive, pharmaceuticals, and industrial applications have distinct specifications and performance requirements for ethylene carbonate-based products. Understanding and adapting to these requirements are essential for market players to effectively cater to diverse customer needs, gain market acceptance, and foster long-term partnerships with end-users.

Leave a Comment