Rising Consumer Demand for Comfort

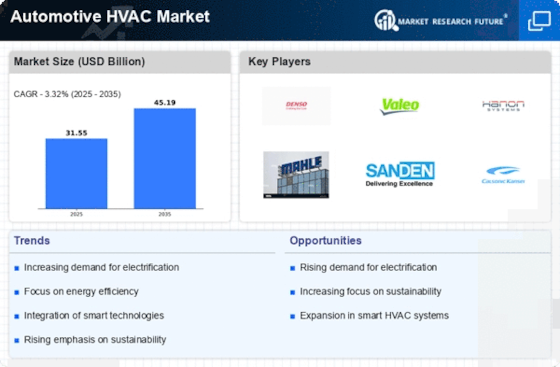

The Automotive HVAC Market is experiencing a notable increase in consumer demand for enhanced comfort features within vehicles. As consumers become more discerning, they seek advanced climate control systems that provide optimal temperature regulation and air quality. This trend is particularly evident in the luxury vehicle segment, where high-end models are equipped with sophisticated HVAC systems. According to recent data, the demand for multi-zone climate control systems has surged, indicating a shift towards personalized comfort. This rising expectation for comfort is driving manufacturers to innovate and improve their HVAC offerings, thereby propelling growth in the Automotive HVAC Market.

Growth of Electric and Hybrid Vehicles

The Automotive HVAC Market is witnessing a transformation due to the increasing adoption of electric and hybrid vehicles. These vehicles require specialized HVAC systems that can operate efficiently without relying on traditional combustion engines. The demand for electric vehicle HVAC systems is projected to grow substantially, as manufacturers focus on developing solutions that optimize energy consumption while maintaining passenger comfort. According to industry forecasts, the market for HVAC systems tailored for electric vehicles is expected to expand significantly in the coming years. This shift towards electrification is reshaping the Automotive HVAC Market, presenting new opportunities for innovation and growth.

Regulatory Push for Emission Reductions

The Automotive HVAC Market is significantly influenced by stringent regulations aimed at reducing vehicle emissions. Governments worldwide are implementing policies that mandate lower greenhouse gas emissions, which in turn affects the design and functionality of HVAC systems. For instance, the introduction of refrigerants with lower global warming potential is becoming a standard requirement. This regulatory environment compels manufacturers to invest in research and development to create more efficient and environmentally friendly HVAC solutions. As a result, the Automotive HVAC Market is likely to witness a shift towards systems that not only comply with regulations but also enhance overall vehicle efficiency.

Consumer Awareness of Indoor Air Quality

The Automotive HVAC Market is increasingly influenced by consumer awareness regarding indoor air quality. As individuals become more health-conscious, there is a growing demand for HVAC systems that can effectively filter and purify the air within vehicles. This trend is prompting manufacturers to incorporate advanced air filtration technologies and purifiers into their HVAC systems. Research indicates that consumers are willing to invest in vehicles equipped with superior air quality features, which is driving competition among automakers. Consequently, the Automotive HVAC Market is evolving to meet these consumer expectations, leading to enhanced product offerings and market growth.

Technological Advancements in HVAC Systems

The Automotive HVAC Market is benefiting from rapid technological advancements that enhance system performance and efficiency. Innovations such as variable refrigerant flow technology and advanced sensors are being integrated into HVAC systems, allowing for more precise climate control and energy savings. Furthermore, the incorporation of smart technologies, such as IoT connectivity, enables real-time monitoring and adjustments based on user preferences. These advancements not only improve user experience but also contribute to the overall efficiency of vehicles. As technology continues to evolve, the Automotive HVAC Market is poised for significant growth driven by these cutting-edge developments.