Advancements in Battery Technology

The Electric Vehicle Motor Market is closely linked to advancements in battery technology, which significantly influence the performance and efficiency of electric vehicles. Innovations in battery chemistry, such as the development of solid-state batteries, are enhancing energy density and reducing charging times. This progress not only improves the overall driving experience but also extends the range of electric vehicles, making them more appealing to consumers. As battery technology continues to evolve, the Electric Vehicle Motor Market is likely to benefit from increased vehicle performance and a broader acceptance of electric vehicles in the automotive market.

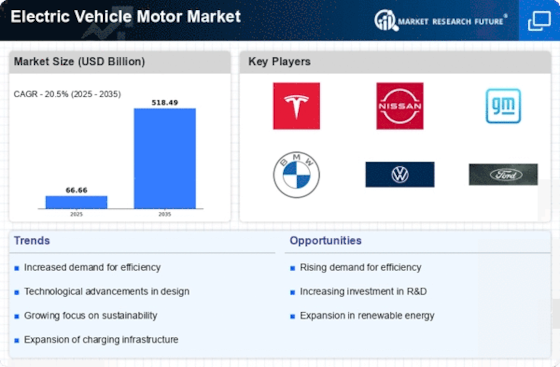

Rising Demand for Electric Vehicles

The Electric Vehicle Motor Market is experiencing a notable surge in demand for electric vehicles (EVs). This trend is driven by increasing consumer awareness regarding environmental issues and the need for sustainable transportation solutions. According to recent data, the sales of electric vehicles have seen a compound annual growth rate (CAGR) of over 20% in the last few years. This rising demand necessitates the development of efficient and high-performance electric motors, which are crucial for enhancing vehicle range and performance. As manufacturers strive to meet consumer expectations, the Electric Vehicle Motor Market is likely to witness significant growth, with innovations in motor technology playing a pivotal role in this transformation.

Government Incentives and Regulations

Government policies and regulations are playing a critical role in shaping the Electric Vehicle Motor Market. Many countries have implemented incentives such as tax rebates, subsidies, and grants to encourage the adoption of electric vehicles. These initiatives not only promote consumer interest but also stimulate manufacturers to invest in advanced motor technologies. For instance, regulations aimed at reducing carbon emissions are compelling automakers to transition from internal combustion engines to electric drivetrains. As a result, the Electric Vehicle Motor Market is expected to expand, driven by both regulatory compliance and financial incentives that facilitate the adoption of electric vehicles.

Increased Competition Among Automakers

The Electric Vehicle Motor Market is witnessing intensified competition among automakers, which is fostering innovation and driving down costs. As traditional automotive manufacturers and new entrants alike invest in electric vehicle technology, the race to develop superior electric motors is becoming increasingly competitive. This competition is not only enhancing the performance and efficiency of electric motors but also making electric vehicles more affordable for consumers. Consequently, the Electric Vehicle Motor Market is likely to experience accelerated growth as automakers strive to differentiate their products and capture a larger share of the expanding electric vehicle market.

Growing Infrastructure for Electric Vehicles

The expansion of charging infrastructure is a vital driver for the Electric Vehicle Motor Market. As more charging stations become available, consumer confidence in electric vehicles is likely to increase, addressing one of the primary concerns regarding range anxiety. Investments in public and private charging networks are facilitating the widespread adoption of electric vehicles, which in turn drives demand for electric motors. The presence of a robust charging infrastructure is essential for the growth of the Electric Vehicle Motor Market, as it supports the transition to electric mobility and encourages manufacturers to innovate in motor design and efficiency.