Market Share

Electric Vehicle Motor Market Share Analysis

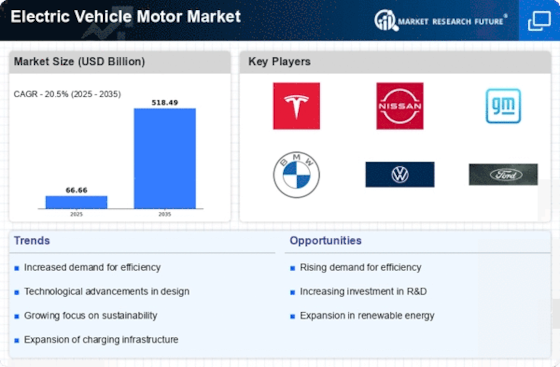

In the dynamic Electric Vehicle (EV) Motor market, companies employ diverse strategies to establish and enhance their market share positioning. Tech changes make a big difference. Firms work hard to create better electric vehicle engines that help save energy, give more power and last longer. Different motor designs, magnet materials and cool systems make the products unique. This attracts auto makers and electric vehicle companies looking for top-notch power solutions.

How much something costs is very important for getting a bigger share of the market in the Electric Vehicle Motor sector. Some businesses use a cost-leadership method, providing reasonably priced motors for many EV makers. Instead, businesses might use high-cost strategies by stressing special features. These include better performance and compatibility with electric motor systems in their products. The picked price plan matches the business's general place in the market and wants to attract certain customers.

Working together and teaming up are very important for growing market share in the Electric Vehicle Motor business. Many times, businesses team up with electric car makers, battery providers and auto tech suppliers to make complete electrical drive solutions. Working together with schools or research centers can lead to joining projects, promoting creativity and making the company a main part of new electric movement developments.

Many companies try to grow their business around the world in order to sell more Electric Vehicle Motors. Businesses want to move into new places, especially in areas that are pushing for more electric travel and green transport. Making their businesses in different places lets companies use many car markets around the world. This helps them benefit from more and more people using electric cars everywhere.

The Electric Vehicle Motor industry focuses on being eco-friendly and taking care of the environment to win more customers. Companies that are in favor of good things for the environment, like using stuff you can recycle or not using rare metals much and making sure their machines don't use too many energy resources connect with car makers who care about nature. Also, making electric car engines helps use energy better. This follows worldwide goals for being green and makes a business look good in the market.

Leave a Comment