Market Trends

Key Emerging Trends in the Electric Vehicle Motor Market

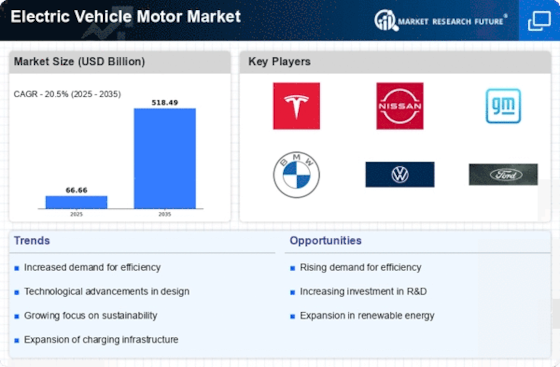

The market for electric vehicle motors is changing a lot. This shows how fast electric cars are becoming popular all around the world and more people adopt them as their choice of transportation. One big change is the drive to make electric car engines work better and faster. New motor designs, better materials and manufacturing are making electric cars more efficient. This leads to longer distance travel with improved overall performance. This change lines up with what the electric car business wants to do. They aim to make electric vehicles more competitive by providing better and stronger power systems for their motors.

The market is seeing a change towards making small and light electric vehicle motors. Makers of cars are trying to make electric vehicles lighter and smaller. Meanwhile, people who make motors are working on creating lightweight motors that still perform well without getting larger in size or weight. This change helps make cars lighter, improving fuel use and increasing how far electric vehicles can go.

Progress in car engine technology is making rare-earth free or less uses of these magnets more popular. Old-style electric motors usually use rare materials, which can cause environmental problems and difficulties with supply. Companies are looking at new types of magnets, such as iron-cobalt mixtures. This is to not need so much rare elements that cost more and can run low in supply. This change matches the industry's promise to be kinder on Earth and find better ways for electric cars.

The market for electric car motors is affected by an increasing need in EVs to have many speed settings. Transmissions that have more speeds give benefits in fuel use and making a vehicle work better, especially when it's moving slow or fast. As electric cars get more popular, the idea of putting in several speeds into their motors is being looked at. This could help improve how they drive and save power better.

People are getting more interested in electric motors built inside wheels. Hub motors, also called in-wheel motors, are built right into the wheels of a car and get rid of the usual need for an old-fashioned system that powers it. This trend makes designing cars easier, improves packing space and lets us design electric vehicles in a more flexible way that can be easily modified.

The electric vehicle motor market is influenced by the expanding range of electric vehicle types, including electric buses, trucks, and two-wheelers. Each vehicle type has unique requirements in terms of motor power, torque, and efficiency. Motor manufacturers are diversifying their product offerings to cater to the specific needs of different electric vehicle segments, contributing to a more specialized and versatile electric motor market. The integration of silicon carbide (SiC) and gallium nitride (GaN) power electronics is a notable trend in the electric vehicle motor market. SiC and GaN technologies offer higher power density, better thermal performance, and improved efficiency compared to traditional silicon-based power electronics. The adoption of these advanced materials in electric vehicle motors contributes to reducing energy losses and enhancing overall system efficiency. Electric cars (BEVs) and half-electric cars (HEVs) are making people want more electric car motors that can give a lot of power without taking up much space. Building strong motors lets us make small and light electric machines. This fixes space problems in cars that use electricity to power them. This trend helps the continuing change to electric cars in the car market and moving toward more energy-lasting and green travel.

Leave a Comment