Market Analysis

In-depth Analysis of Electric Vehicle Motor Market Industry Landscape

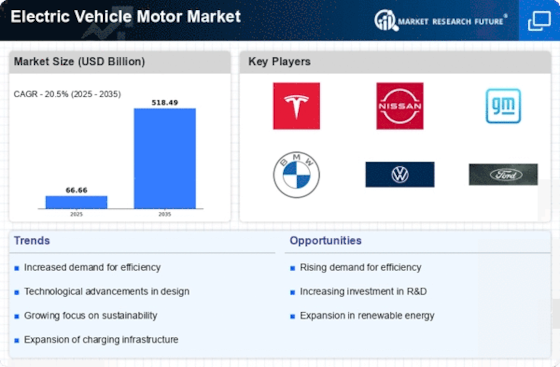

The Electric Vehicle (EV) Motor market operates at the forefront of the automotive industry's transformation towards sustainable and eco-friendly transportation. The factors that make up electric vehicle motors market are influenced by several important things, and the worldwide move for clean energy solutions is in charge. As the world tries to cut down carbon emissions and fight climate change, people want electric cars more than ever. This makes demand for motors in those vehicles grow quickly too. Governments all over the world are making rules, giving rewards and regulations to encourage people to use electric cars. This is helping create a good situation for growing the market of EV motors.

Technology improvements help change the electric vehicle motor market. Continuous changes in engine design, power electronics and battery improvement help make electric cars better at using energy, how far they can go without running out of juice and general performance. New things like motors that don't need rare earth, power electronics made of silicon carbide and improved cooling systems make electric car engines more competitive. These tech advances not only push the market forward, but also help make electric cars cheaper and more attractive for people to buy.

Competition in the market is pushing changes and growth within electric vehicle motor section. Big car makers and newcomers being there helps make cars better. Businesses work hard to make engines that use energy better, have more power in less space and cost less money for making them. Big businesses work together, join forces or buy smaller ones. They do this to stay ahead in their industry and grow the places they sell stuff.

The choices and knowledge of people are very important in making how electric vehicle motors work. As more people learn about environment problems, they are starting to prefer green ways of traveling. Things like how far electric cars can drive, where they can charge up and their overall speed make them popular choices. People wanting green options and needing electric cars with better performance push for improvements in the tech of their motors. This makes investing more popular. Supply chain dynamics, including the availability of raw materials, manufacturing capabilities, and global logistics, impact the overall market dynamics. The sourcing of materials such as rare earth metals and lithium, key components in electric vehicle motors and batteries, can be subject to supply chain disruptions and geopolitical considerations. Ensuring a resilient and efficient supply chain is crucial for meeting the growing demand for electric vehicle motors and maintaining market stability. Economic considerations, including manufacturing costs, pricing, and total cost of ownership, influence market dynamics. The reduction in battery costs, economies of scale in production, and advancements in motor manufacturing technologies contribute to making electric vehicles more cost-competitive with internal combustion engine vehicles. As electric vehicles become more affordable and offer competitive total cost of ownership, the demand for electric vehicle motors is expected to grow. Developing infrastructure, especially adding more places to charge electric cars, also affects how the market works. How easy it is to charge electric cars and where they can do so affects how much people trust these vehicles and whether or not they decide to use them. Governments, companies and stakeholders in industries put money into charging stations to help the electric vehicle market grow. This also affects how much people want electric car engines.

Leave a Comment