Rising Environmental Awareness

Rising environmental awareness among consumers is a key driver for the Electric Vehicle Battery Charger Market. As concerns about climate change and air pollution grow, more individuals are seeking sustainable transportation options. Electric vehicles are often viewed as a cleaner alternative to traditional gasoline-powered cars, leading to increased demand for electric vehicle battery chargers. This shift in consumer behavior is supported by various studies indicating that a significant portion of the population is willing to pay a premium for eco-friendly products. Consequently, the Electric Vehicle Battery Charger Market is likely to benefit from this trend, as more consumers transition to electric vehicles and require reliable charging solutions. The market is expected to see a substantial increase in charger installations, with projections estimating a rise in demand by over 30% in the next five years.

Expansion of Electric Vehicle Models

The expansion of electric vehicle models offered by manufacturers is significantly influencing the Electric Vehicle Battery Charger Market. As automakers introduce a wider range of electric vehicles, including SUVs, trucks, and luxury models, the appeal of electric vehicles is broadening. This diversification is likely to attract a more extensive customer base, which in turn increases the demand for charging infrastructure. With more options available, consumers are more inclined to consider electric vehicles as viable alternatives to traditional cars. Consequently, the Electric Vehicle Battery Charger Market is poised for growth, as the need for compatible charging solutions rises. Market forecasts indicate that the number of electric vehicle models will triple by 2030, further driving the demand for efficient and accessible charging stations.

Government Incentives and Regulations

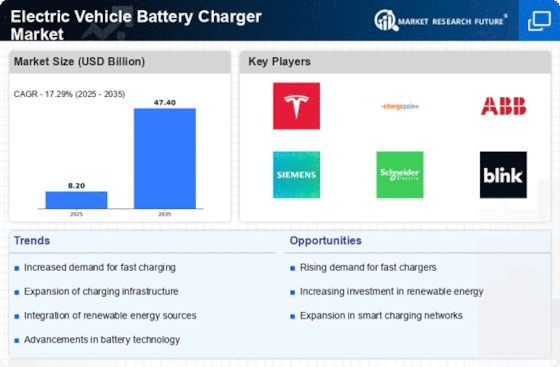

The Electric Vehicle Battery Charger Market is experiencing a surge in demand due to favorable government incentives and regulations. Many countries are implementing policies that promote electric vehicle adoption, which in turn drives the need for efficient charging solutions. For instance, tax credits, rebates, and grants for both consumers and manufacturers are becoming increasingly common. These incentives not only lower the initial cost of electric vehicles but also encourage the installation of charging infrastructure. As a result, the market for electric vehicle battery chargers is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This regulatory support is crucial for the Electric Vehicle Battery Charger Market, as it creates a conducive environment for investment and innovation.

Investment in Charging Infrastructure

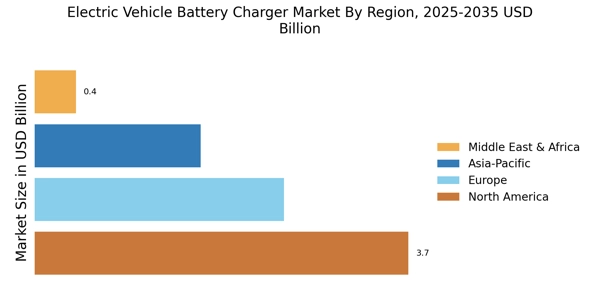

Investment in charging infrastructure is a crucial driver for the Electric Vehicle Battery Charger Market. As electric vehicle adoption accelerates, the need for a robust and widespread charging network becomes increasingly apparent. Public and private sectors are recognizing this necessity, leading to significant investments in charging stations and related technologies. For instance, major cities are allocating funds to install fast charging stations in strategic locations, making it more convenient for electric vehicle owners. This expansion of infrastructure not only supports current electric vehicle users but also encourages potential buyers by alleviating range anxiety. Analysts predict that the investment in charging infrastructure will reach billions of dollars in the next few years, thereby propelling the Electric Vehicle Battery Charger Market forward and ensuring its sustainability.

Technological Advancements in Charging Solutions

Technological advancements are playing a pivotal role in shaping the Electric Vehicle Battery Charger Market. Innovations such as fast charging, wireless charging, and smart charging solutions are enhancing the user experience and making electric vehicles more appealing. Fast charging stations, for example, can recharge a vehicle's battery to 80% in under 30 minutes, significantly reducing downtime for users. Furthermore, the integration of smart technologies allows for real-time monitoring and optimization of charging processes, which can lead to cost savings and improved efficiency. As these technologies continue to evolve, they are likely to attract more consumers to electric vehicles, thereby expanding the Electric Vehicle Battery Charger Market. Market analysts predict that the demand for advanced charging solutions will increase, potentially doubling the number of charging stations by 2030.