Government Support and Policy Initiatives

Government support and policy initiatives are pivotal in shaping the electric vehicle-battery-charger market. Various federal and state programs are being implemented to promote the adoption of electric vehicles and the development of charging infrastructure. For example, incentives such as tax credits and rebates for EV purchases are encouraging consumers to make the switch. Additionally, funding for the installation of charging stations is being allocated to enhance accessibility. These initiatives not only stimulate market growth but also create a favorable environment for manufacturers and service providers. As policies evolve to support the transition to electric mobility, the electric vehicle-battery-charger market is likely to benefit from increased investment and innovation.

Rising Consumer Demand for Electric Vehicles

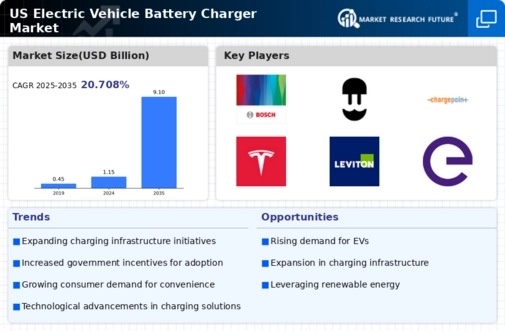

The electric vehicle-battery-charger market experiences a notable surge in consumer demand for electric vehicles (EVs). As more individuals seek sustainable transportation options, the market is projected to grow significantly. According to recent data, EV sales in the US have increased by over 30% in the past year alone. This growing interest in EVs directly correlates with the need for efficient charging solutions, thereby driving the electric vehicle-battery-charger market. Consumers are increasingly prioritizing convenience and accessibility, leading to a demand for more charging stations and faster charging technologies. This trend suggests that manufacturers and service providers must adapt to meet the evolving preferences of consumers, which could further stimulate market growth.

Partnerships and Collaborations in the Industry

Partnerships and collaborations among stakeholders in the electric vehicle-battery-charger market are becoming increasingly common. Automakers, technology companies, and energy providers are joining forces to develop integrated solutions that enhance the charging experience. For instance, collaborations between EV manufacturers and charging network operators aim to create seamless charging experiences for consumers. These partnerships can lead to the establishment of extensive charging networks, which are essential for supporting the growing number of electric vehicles on the road. By pooling resources and expertise, stakeholders can accelerate the development of innovative charging technologies and infrastructure, thereby driving the electric vehicle-battery-charger market forward.

Technological Innovations in Charging Solutions

Technological advancements play a crucial role in shaping the electric vehicle-battery-charger market. Innovations such as ultra-fast charging stations and wireless charging technologies are emerging, enhancing the user experience and reducing charging times. For instance, ultra-fast chargers can deliver up to 350 kW, allowing EVs to charge to 80% in approximately 15 minutes. This rapid development in charging technology not only improves convenience for users but also encourages more consumers to transition to electric vehicles. As these technologies become more prevalent, they are likely to attract investments and partnerships, further propelling the electric vehicle-battery-charger market forward. The integration of smart technologies, such as mobile apps for locating charging stations, also enhances the overall charging experience.

Increased Focus on Sustainability and Environmental Impact

The electric vehicle-battery-charger market is significantly influenced by the growing emphasis on sustainability and reducing carbon footprints. As environmental concerns become more pressing, consumers and businesses alike are shifting towards greener alternatives. The US government has set ambitious targets to reduce greenhouse gas emissions, which aligns with the increasing adoption of electric vehicles. This societal shift towards sustainability is likely to drive demand for electric vehicle charging solutions, as more individuals seek to contribute to environmental preservation. Furthermore, companies that prioritize sustainable practices in their operations may gain a competitive edge in the electric vehicle-battery-charger market, appealing to eco-conscious consumers and investors.