Consumer Awareness and Education

Rising consumer awareness regarding the benefits of electric vehicles is driving the electric vehicle-on-board-charger market. Educational campaigns and marketing efforts by manufacturers and environmental organizations are effectively informing potential buyers about the advantages of EVs, including lower operating costs and reduced emissions. As of 2025, surveys indicate that nearly 70% of consumers are considering purchasing an electric vehicle, with many expressing interest in understanding the charging process better. This heightened awareness is likely to lead to increased demand for on-board chargers that are user-friendly and efficient. The electric vehicle-on-board-charger market is thus positioned to capitalize on this trend, as manufacturers develop products that cater to the informed consumer.

Advancements in Battery Technology

Innovations in battery technology are significantly impacting the electric vehicle-on-board-charger market. Enhanced battery performance, including increased energy density and faster charging capabilities, is driving the demand for advanced on-board chargers. As of 2025, the average range of electric vehicles has improved, with many models now exceeding 300 miles on a single charge. This advancement necessitates the development of more sophisticated charging systems that can efficiently manage higher power levels. The electric vehicle-on-board-charger market is likely to see a surge in demand for chargers that can accommodate these new battery technologies, ensuring that consumers can charge their vehicles quickly and effectively, thereby enhancing the overall user experience.

Government Policies and Regulations

Supportive government policies and regulations are playing a pivotal role in shaping the electric vehicle-on-board-charger market. Federal and state incentives aimed at promoting electric vehicle adoption, such as tax credits and rebates, are encouraging consumers to transition to electric vehicles. As of 2025, various states have implemented regulations mandating the installation of charging infrastructure in new developments, further bolstering the market. These policies not only enhance the attractiveness of electric vehicles but also create a favorable environment for the electric vehicle-on-board-charger market to flourish. Manufacturers are likely to respond by innovating and expanding their product offerings to align with regulatory requirements and consumer expectations.

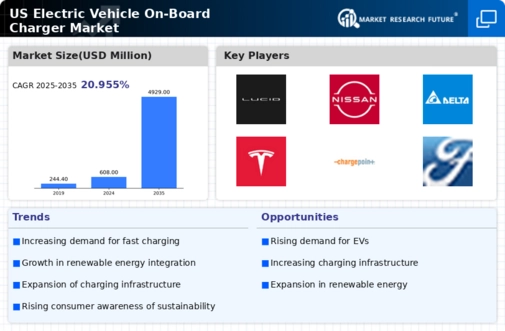

Growing Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the electric vehicle-on-board-charger market. As of 2025, EV sales in the US have surged, with projections indicating that they could account for over 30% of total vehicle sales by 2030. This shift is largely influenced by rising environmental awareness and the desire for reduced fuel costs. Consequently, the demand for efficient on-board charging solutions is expected to rise, as consumers seek to maximize the convenience and performance of their electric vehicles. Thus, the electric vehicle-on-board-charger market is positioned to benefit from this growing trend. Manufacturers strive to meet the evolving needs of consumers who prioritize sustainability and innovation in their vehicle choices.

Infrastructure Development Initiatives

The expansion of charging infrastructure across the US is a crucial factor influencing the electric vehicle-on-board-charger market. Government initiatives and private investments are leading to the establishment of more charging stations, which is essential for supporting the growing number of electric vehicles on the road. As of 2025, the US has seen a significant increase in public charging stations, with estimates suggesting a growth of over 50% in the past two years. This development not only alleviates range anxiety among consumers but also encourages the adoption of electric vehicles. Consequently, the electric vehicle-on-board-charger market is expected to thrive as more vehicles are equipped with advanced charging solutions that align with the expanding infrastructure.