Rising Environmental Awareness

The growing awareness of environmental issues is a key driver for the Electric Car Rental Market. Consumers are increasingly concerned about their carbon footprints and are seeking sustainable transportation options. This shift in consumer behavior is prompting rental companies to diversify their fleets to include more electric vehicles. According to recent surveys, approximately 70% of consumers express a preference for renting electric cars over traditional gasoline vehicles, indicating a significant market shift. This trend is expected to continue, as more individuals prioritize eco-friendly choices in their travel plans. Consequently, the Electric Car Rental Market is likely to expand as companies respond to this demand by offering a wider range of electric vehicle options.

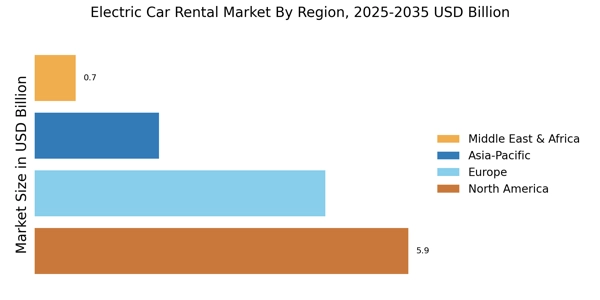

Urbanization and Mobility Trends

Urbanization is reshaping transportation dynamics, thereby influencing the Electric Car Rental Market. As cities become more densely populated, the demand for convenient and flexible transportation solutions increases. Electric car rentals offer an attractive alternative to traditional car ownership, particularly in urban areas where parking and maintenance can be challenging. In 2023, urban areas accounted for over 60% of total car rentals, with electric vehicles gaining traction due to their lower operational costs and environmental benefits. This trend suggests that as urbanization continues, the Electric Car Rental Market will likely see a surge in demand, driven by the need for efficient and sustainable mobility solutions.

Regulatory Support for Electric Vehicles

The Electric Car Rental Market benefits from increasing regulatory support aimed at promoting electric vehicles. Governments are implementing policies that incentivize the adoption of electric cars, such as tax rebates, grants, and subsidies. For instance, various countries have set ambitious targets for reducing carbon emissions, which often include mandates for electric vehicle usage. This regulatory environment encourages rental companies to expand their electric vehicle fleets, thereby enhancing the overall market. In 2023, it was reported that over 30 countries had established regulations favoring electric vehicle adoption, which is likely to bolster the Electric Car Rental Market in the coming years. As these regulations become more stringent, the demand for electric car rentals is expected to rise, aligning with global sustainability goals.

Cost Competitiveness of Electric Vehicles

The cost competitiveness of electric vehicles is a significant factor influencing the Electric Car Rental Market. As battery prices continue to decline, the overall cost of electric vehicles is becoming more comparable to traditional gasoline cars. This price parity is encouraging rental companies to invest in electric fleets, as the total cost of ownership becomes more favorable. In 2023, the price of electric vehicles dropped by approximately 15% compared to previous years, making them more accessible to rental companies and consumers alike. This trend indicates that as electric vehicles become more economically viable, the Electric Car Rental Market is poised for growth, attracting a broader customer base seeking cost-effective and sustainable transportation options.

Technological Innovations in Electric Vehicles

Technological advancements play a pivotal role in shaping the Electric Car Rental Market. Innovations in battery technology, such as increased energy density and faster charging capabilities, are making electric vehicles more appealing to consumers. The introduction of advanced telematics and connectivity features enhances the user experience, allowing for seamless integration with mobile applications for booking and managing rentals. In 2023, the average range of electric vehicles increased to over 300 miles on a single charge, which significantly reduces range anxiety among potential renters. This trend suggests that as technology continues to evolve, the Electric Car Rental Market will likely experience accelerated growth, driven by consumer demand for more efficient and user-friendly electric vehicles.