Expansion of Luxury Travel

The luxury travel sector is expanding, which positively impacts the luxury car-rental market. With an increase in international tourism and domestic travel, affluent travelers are seeking premium transportation options to enhance their travel experiences. Data indicates that luxury travel spending in the US has risen by 10% over the past year, reflecting a growing preference for high-end services. This trend is likely to encourage rental companies to diversify their fleets and offer more luxury options, catering to the evolving demands of travelers. As the luxury travel market continues to flourish, the luxury car-rental market is poised to benefit significantly from this upward trajectory.

Increasing Disposable Income

The luxury car-rental market is experiencing growth due to rising disposable income among consumers in the US. As individuals have more financial flexibility, they are more inclined to rent high-end vehicles for special occasions or leisure travel. According to recent data, the average household income has seen an increase of approximately 5% annually, which correlates with a heightened demand for luxury rentals. This trend suggests that as economic conditions improve, more consumers may opt for premium experiences, thereby driving the luxury car-rental market. Additionally, the affluent demographic, which constitutes a significant portion of the market, is likely to continue seeking exclusive and high-quality services, further propelling market growth.

Growing Demand for Unique Experiences

There is a notable shift in consumer preferences towards unique and memorable experiences, which is influencing the luxury car-rental market. Consumers are increasingly seeking out distinctive offerings that allow them to stand out during special events or vacations. This trend is reflected in the rising popularity of exotic and rare vehicle rentals, which have seen a surge in demand. Market data suggests that rentals of high-performance sports cars and luxury SUVs have increased by 15% in the past year. As consumers prioritize experiences over material possessions, the luxury car-rental market is likely to capitalize on this trend by providing tailored services that cater to the desire for exclusivity and adventure.

Technological Advancements in Rental Services

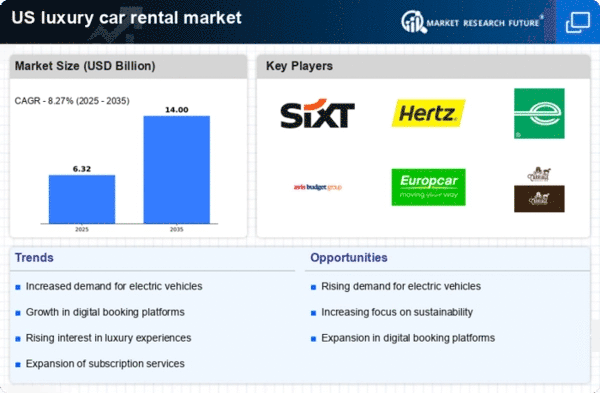

Technological innovations are transforming the luxury car-rental market, making it more accessible and user-friendly. The integration of mobile applications and online booking systems has streamlined the rental process, allowing consumers to reserve luxury vehicles with ease. Recent statistics show that over 60% of luxury car rentals are now booked through digital platforms, indicating a shift in consumer behavior. Furthermore, advancements in vehicle technology, such as electric and autonomous vehicles, are likely to attract a new segment of environmentally conscious consumers. This technological evolution not only enhances customer satisfaction but also positions rental companies to adapt to changing market dynamics, thereby fostering growth in the luxury car-rental market.

Influence of Social Media and Celebrity Culture

The impact of social media and celebrity culture on consumer behavior is a significant driver for the luxury car-rental market. Platforms such as Instagram and TikTok have created a culture where luxury experiences are showcased and celebrated, influencing potential renters. Data indicates that 70% of millennials are inspired to rent luxury vehicles after seeing them featured in social media posts. This phenomenon suggests that as social media continues to shape consumer preferences, the luxury car-rental market may see increased demand driven by the desire to emulate the lifestyles of influencers and celebrities. Consequently, rental companies may need to enhance their marketing strategies to leverage this trend effectively.