Regulatory Support

Regulatory frameworks are increasingly supportive of drone integration within the Global Drones for Oil and Gas Market Industry. Governments worldwide are establishing guidelines that facilitate the safe operation of drones in oil and gas operations. For example, the Federal Aviation Administration in the United States has implemented regulations that streamline the approval process for commercial drone use. This regulatory environment encourages companies to adopt drone technology for tasks such as aerial surveying and monitoring, thereby enhancing operational efficiency and compliance. The anticipated growth in this sector is indicative of a broader acceptance of drone technology in regulated industries.

Enhanced Data Analytics

The integration of advanced data analytics with drone technology is transforming the Global Drones for Oil and Gas Market Industry. Drones equipped with sensors collect vast amounts of data, which can be analyzed to improve decision-making processes. For example, data from drone surveys can be used to create detailed 3D models of oil fields, facilitating better planning and resource allocation. This analytical capability is becoming increasingly vital as companies strive to optimize operations and reduce costs. The synergy between drones and data analytics is likely to propel market growth, reflecting the industry's shift towards data-driven strategies.

Environmental Monitoring

The increasing emphasis on environmental monitoring within the Global Drones for Oil and Gas Market Industry is driving demand for drone technology. Drones are utilized for monitoring emissions, detecting leaks, and assessing environmental impacts, which are crucial for compliance with environmental regulations. For instance, drones can cover vast areas quickly, providing real-time data that helps companies respond to environmental concerns more effectively. This capability not only aids in regulatory compliance but also enhances corporate responsibility, making drones an essential tool in the oil and gas sector's sustainability efforts.

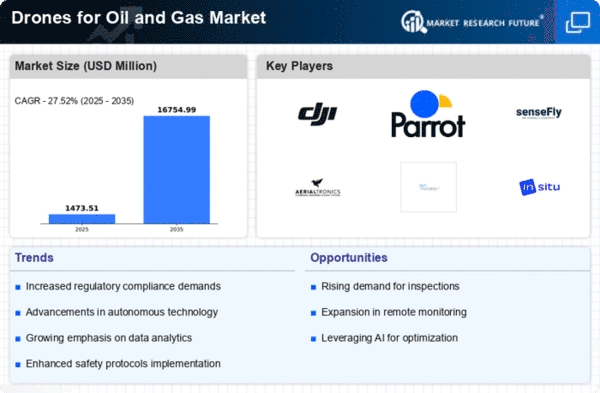

Market Growth Projections

The Global Drones for Oil and Gas Market Industry is poised for substantial growth, with projections indicating an increase from 1.16 USD Billion in 2024 to 16.7 USD Billion by 2035. This remarkable growth trajectory suggests a compound annual growth rate of 27.47% from 2025 to 2035. Such figures highlight the increasing adoption of drone technology across various applications in the oil and gas sector, including exploration, monitoring, and maintenance. The anticipated expansion underscores the industry's recognition of drones as critical tools for enhancing operational efficiency and safety.

Cost Reduction Initiatives

Cost reduction is a primary driver in the Global Drones for Oil and Gas Market Industry, as companies seek to minimize operational expenses. Drones can significantly lower costs associated with inspections, maintenance, and monitoring by reducing the need for manned aircraft and ground crews. For example, using drones for pipeline inspections can decrease costs by up to 80% compared to traditional methods. This financial incentive is compelling, especially as the market is expected to grow from 1.16 USD Billion in 2024 to an estimated 16.7 USD Billion by 2035, with a CAGR of 27.47% from 2025 to 2035.

Technological Advancements

The Global Drones for Oil and Gas Market Industry is experiencing rapid technological advancements that enhance operational efficiency and safety. Innovations in drone technology, such as improved battery life, enhanced imaging capabilities, and autonomous flight systems, are driving adoption. For instance, drones equipped with thermal imaging can detect gas leaks and monitor pipeline integrity, reducing the need for manual inspections. As a result, the market is projected to reach 1.16 USD Billion in 2024, reflecting a growing reliance on these technologies to optimize resource management and minimize environmental impact.