Global Directors and Officers Insurance Market Overview:

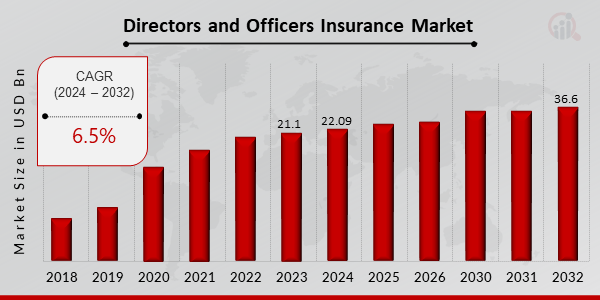

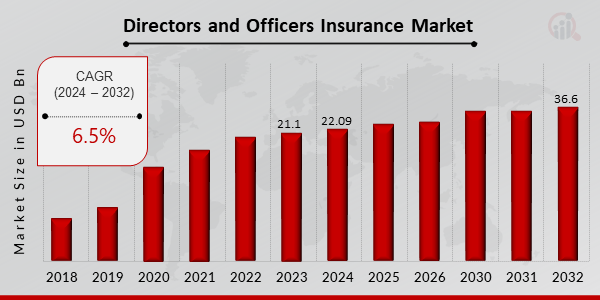

Directors and Officers Insurance Market Size was estimated at 21.1 (USD Billion) in 2023. The Directors and Officers Insurance Market Industry is expected to grow from 22.09 (USD Billion) in 2024 to 36.6 (USD Billion) by 2032. The Directors and Officers Insurance Market CAGR (growth rate) is expected to be around 6.5% during the forecast period (2024 - 2032).

Key Directors and Officers Insurance Market Trends Highlighted

Flourishing technology, elevated focus from regulators and increased shareholder activism are some of the proponents for the demand for Director and Officers (D) insurance. The extended reach of social media and other forms of communication has increased the level of risk because of the cost of reputation loss, thus creating more need for D coverage. Also, due to consolidations, cross-border mergers, extension of global supply chains, and more and more sophisticated, D demand is also on the rise.

The D insurance market has opportunities in responding to such specific needs of different sectors such as healthcare, technology, and financial services. This enables the insurers to provide industry specific solutions and also add risk management as a part of the service. There is a growing awareness of D insurance among independent/non-executive directors and contractors, which provides opportunities for insurers to grow their market.

One of the changes that have been observed in the D insurance market of late is the availability of side-A difference-in-conditions (DIC) coverage, which protects the company itself, in addition to all other D and O individual policyholders. They also offered new products and coverage, including broader cyber and employment practices liability, which became available because of and for the sake of the modern and complex governance structure of corporations with many risks of litigation in these areas.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Directors and Officers Insurance Market Drivers

Increasing Regulatory Scrutiny

Directors and Officers (DOs) are increasingly facing regulatory scrutiny from government agencies around the world. This is due to a number of factors, including the global financial crisis, the rise of shareholder activism, and the increasing complexity of corporate governance. As a result, DOs are increasingly turning to DO insurance to protect themselves from personal liability. The Directors and Officers Insurance Market Industry is expected to witness significant growth over the next ten years. The market is expected to grow from USD 12.83 billion in 2023 to USD 21.05 billion by 2032, at a CAGR of 5.65%. The growth of the market is attributed to a number of factors, including the increasing regulatory scrutiny of DOs, the rising number of shareholder lawsuits, and the increasing complexity of corporate governance. The increasing regulatory scrutiny of DOs is one of the key drivers of the growth of the DO insurance market. In recent years, government agencies around the world have been cracking down on corporate misconduct. This has led to an increase in the number of investigations and enforcement actions against DOs. As a result, DOs are increasingly turning to DO insurance to protect themselves from personal liability.

Rising Number of Shareholder Lawsuits

The number of shareholder lawsuits against DOs has been rising in recent years. This is due to a number of factors, including the increasing availability of litigation funding, the rise of shareholder activism, and the increasing complexity of corporate governance. As a result, DOs are increasingly turning to DO insurance to protect themselves from personal liability.

Increasing Complexity of Corporate Governance

The increasing complexity of corporate governance is another key driver of the growth of the DO

insurance market. In recent years, there has been a proliferation of new laws and regulations governing corporate governance. This has made it more difficult for DOs to comply with their fiduciary duties. As a result, DOs are increasingly turning to DO insurance to protect themselves from personal liability.

Directors and Officers Insurance Market Segment Insights:

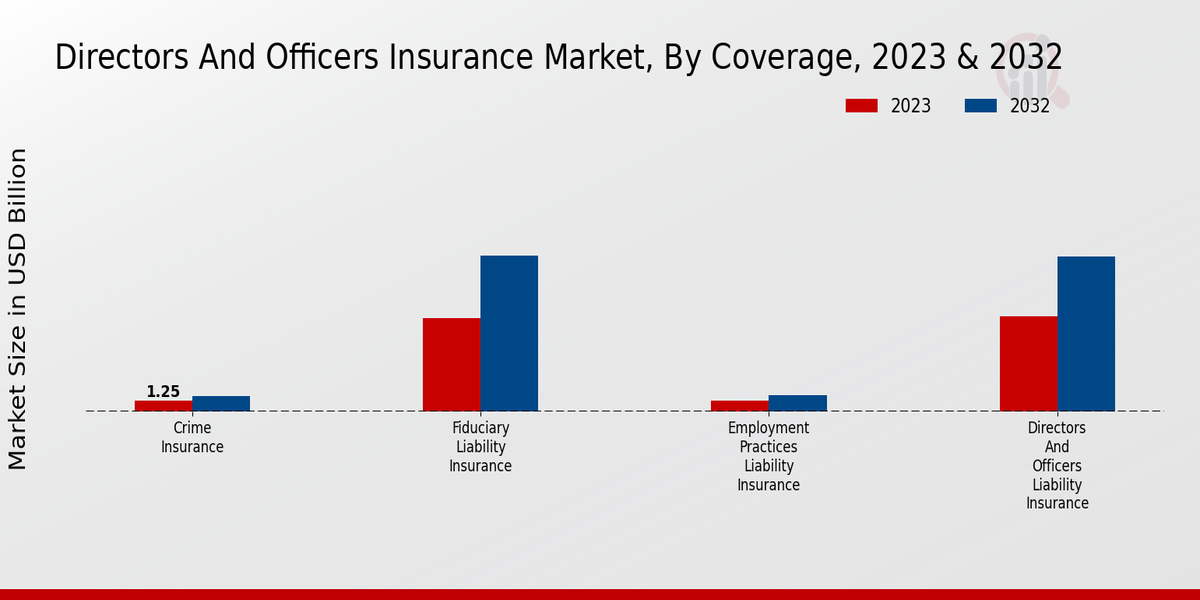

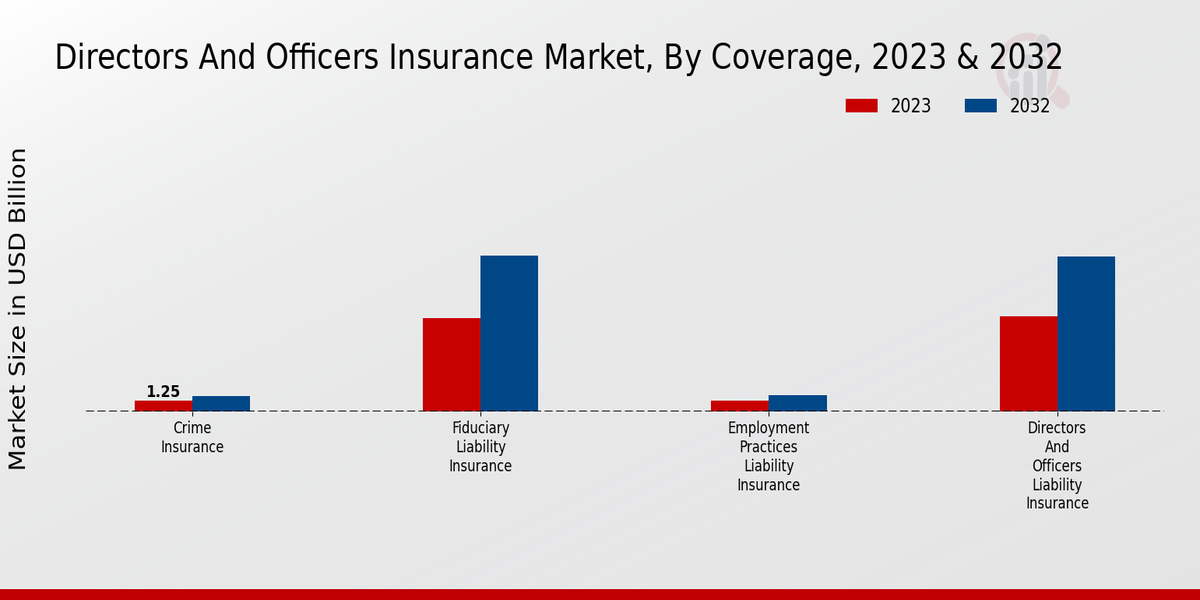

Directors and Officers Insurance Market Coverage Insights

Coverage Segment Insight and Overview The coverage segment is a crucial aspect of the Directors and Officers Insurance Market, encompassing various insurance policies that protect individuals and organizations from financial liabilities arising from their roles and responsibilities. Among the key coverage types, Directors and Officers Liability Insurance (D) stands out as the most prevalent, accounting for a significant portion of the market revenue. D insurance provides protection to Directors and Officers of companies against claims alleging mismanagement, breach of fiduciary duties, or other wrongful acts. Employment Practices Liability Insurance (EPLI) is another significant coverage type within the segment, addressing the growing concerns over employment-related lawsuits. EPLI policies protect organizations from claims related to discrimination, harassment, wrongful termination, and other employment practices violations. Fiduciary Liability Insurance, on the other hand, safeguards individuals and organizations acting in a fiduciary capacity, such as trustees, executors, and investment advisors, against claims alleging breaches of their fiduciary duties. Crime Insurance, also known as fidelity insurance, plays a vital role in the coverage segment by protecting businesses from financial losses resulting from employee theft, fraud, or other criminal activities. The demand for Crime Insurance is particularly high in industries such as retail, finance, and hospitality, where cash handling and financial transactions are prevalent. The Directors and Officers Insurance Market is expected to witness steady growth in the coming years, driven by factors such as increasing regulatory scrutiny, rising litigation costs, and expanding corporate governance practices. The adoption of D, EPLI, Fiduciary

Liability Insurance, and Crime Insurance is becoming increasingly essential for businesses and individuals seeking to mitigate financial risks associated with their operations and responsibilities.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Directors and Officers Insurance Market Organization Size Insights

The Directors and Officers Insurance Market is segmented based on organization size into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. The Directors and Officers Insurance Market revenue from SMEs is anticipated to reach USD 8.9 billion by 2026, growing at a CAGR of 6.5% during the forecast period. The increasing awareness of the importance of Directors and Officers (D) insurance among SMEs is driving the growth of this segment. SMEs are increasingly seeking D insurance to protect themselves from the financial consequences of lawsuits alleging mismanagement or breach of fiduciary duty. The large Enterprises segment held a significant market share in 2021 and is expected to continue its dominance during the forecast period. Large enterprises are more likely to face complex legal challenges and regulatory scrutiny, which is driving the demand for D insurance in this segment. Moreover, the increasing number of cross-border transactions and joint ventures is further fueling the growth of the D insurance market among large enterprises.

Directors and Officers Insurance Market Industry Vertical Insights

The Directors and Officers Insurance Market is segmented by industry vertical into Financial Services, Healthcare, Technology, Manufacturing, and Retail. The Financial Services segment accounted for the largest share of the market in 2023 and is expected to continue to grow at a CAGR of 5.8% through 2032. The Healthcare segment is expected to grow at a CAGR of 6.1% during the same period. The Technology segment is expected to grow at a CAGR of 5.9% during the same period. The Manufacturing segment is expected to grow at a CAGR of 5.7% during the same period. The Retail segment is expected to grow at a CAGR of 5.6% during the same period. The growth of the Directors and Officers Insurance Market is being driven by a number of factors, including the increasing number of regulatory and compliance requirements, the rising cost of litigation, and the growing awareness of the importance of protecting Directors and Officers from personal liability. The market is also being driven by the increasing number of mergers and acquisitions, which is creating a need for Directors and Officers to protect themselves from potential liabilities. The Directors and Officers Insurance Market is a highly competitive market with a number of major players. Some of the key players in the market include AIG, Chubb, Zurich Insurance Group, and Berkshire Hathaway. These companies are competing on the basis of price, coverage, and service.

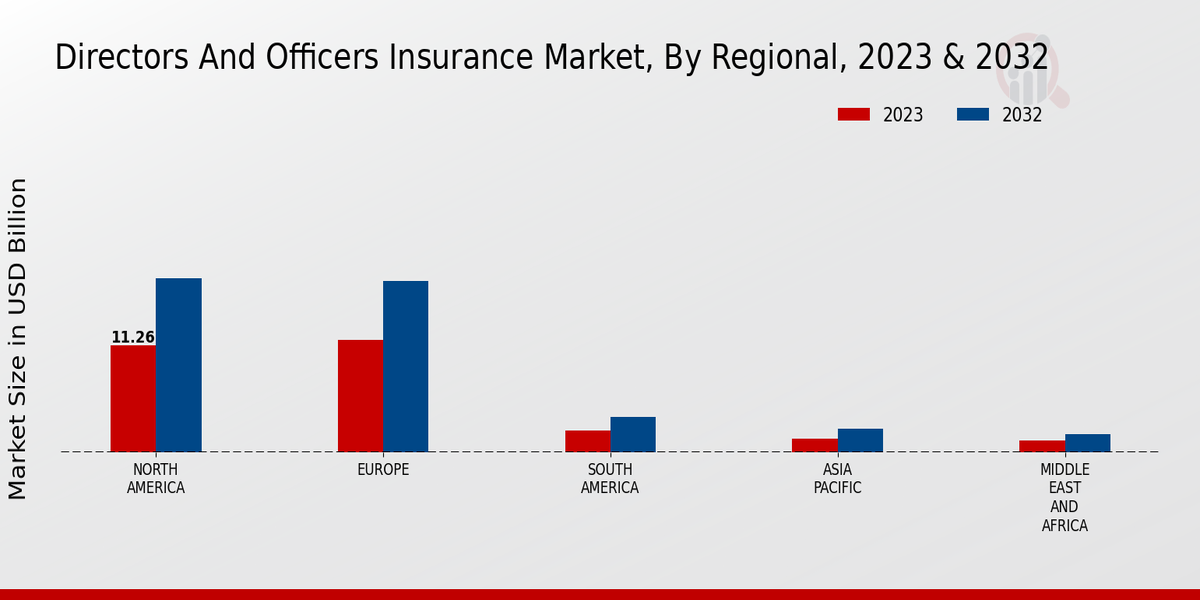

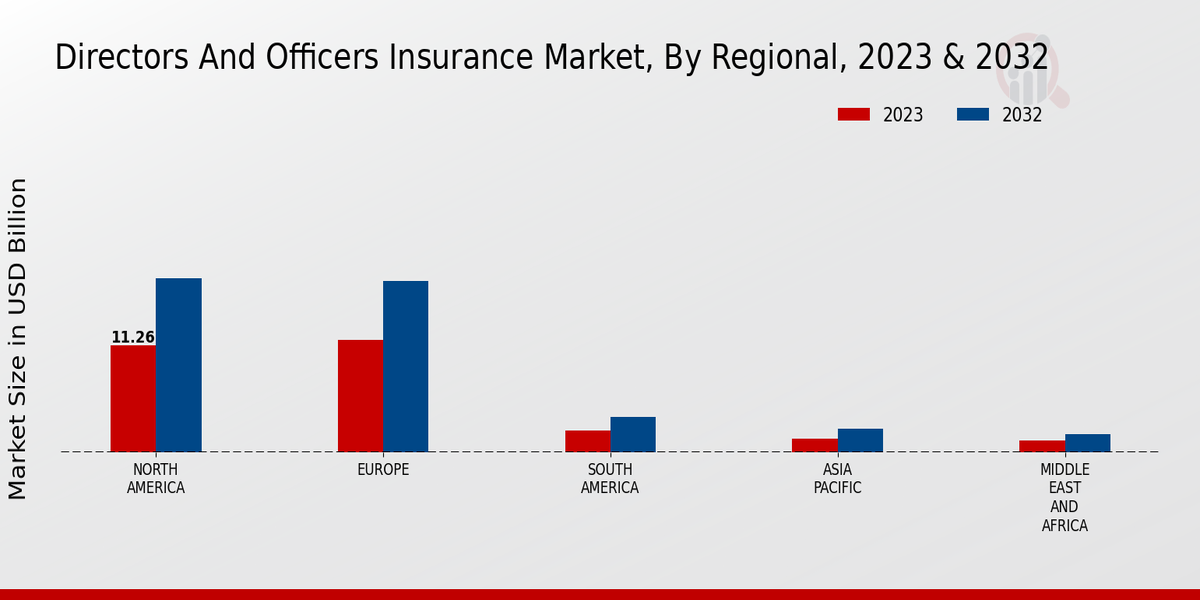

Directors and Officers Insurance Market Regional Insights

The Directors and Officers Insurance Market is segmented into North America, Europe, APAC, South America, and MEA. North America is the largest market for Directors and Officers Insurance, accounting for over 40% of the global market revenue in 2023. The region is expected to continue to dominate the market throughout the forecast period, driven by the presence of a large number of publicly traded companies and the increasing demand for Directors and Officers Insurance coverage. Europe is the second-largest market for Directors and Officers Insurance, accounting for over 30% of the global market revenue in 2023. The region is expected to witness steady growth over the forecast period, driven by the increasing awareness of Directors and Officers Insurance among companies and the growing number of cross-border transactions. APAC is the fastest-growing market for Directors and Officers Insurance, with a CAGR of over 6% during the forecast period. The region is expected to be driven by the increasing economic growth and the rising number of publicly traded companies. South America and the MEA are expected to witness moderate growth over the forecast period, driven by the increasing demand for Directors and Officers Insurance coverage among companies in these regions.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Directors and Officers Insurance Market Key Players And Competitive Insights:

Major players in the Directors and Officers Insurance Market industry are constantly seeking ways to gain a competitive advantage. Leading Directors and Officers of Insurance Market players are investing in research and development to create innovative products and services. They are also expanding their geographic reach to tap into new markets. The Directors and Officers Insurance Market is expected to witness significant growth in the coming years, driven by factors such as increasing regulatory compliance and the growing number of mergers and acquisitions. A leading player in the Directors and Officers Insurance Market is Chubb. The company offers a wide range of Directors and Officers (DO) insurance products and services to protect companies and their Directors and Officers from financial loss. Chubb has a strong global presence and a reputation for providing high-quality insurance products and services. The company is committed to providing innovative solutions to meet the changing needs of its clients. A competitor company in the Directors and Officers Insurance Market is AIG. AIG offers a comprehensive suite of DO insurance products and services to meet the needs of businesses of all sizes. The company has a strong focus on providing customized solutions to meet the specific needs of its clients. AIG is also committed to providing excellent customer service and support.

Key Companies in the Directors and Officers Insurance Market Include:

-

Lloyd's of London

-

Everest Re Group Ltd.

-

Munich Reinsurance America, Inc.

-

Zurich Insurance Group Ltd.

-

AXA SA

-

AIG

-

Liberty Mutual Insurance Group

-

Tokio Marine Holdings, Inc.

-

Travelers Companies, Inc.

-

Chubb Limited

-

Allianz SE

-

Marsh McLennan Companies, Inc.

-

Berkshire Hathaway Specialty Insurance

-

CNA Financial Corporation

-

Swiss Reinsurance Company Ltd.

Directors and Officers Insurance Industry Developments

The Directors and Officers (DO) insurance market is projected to witness a surge over the forecast period, reaching an estimated market size of USD 21.05 billion by 2032, expanding at a CAGR of 5.65% from 2024 to 2032. The growing demand for DO insurance is primarily attributed to the increasing regulatory scrutiny, heightened awareness of corporate governance, and the rising frequency and severity of lawsuits against directors and officers. Recent market developments include the expansion of DO coverage to include cyber risks, the introduction of new products tailored to specific industries, and the emergence of innovative risk management solutions. Key players in the DO insurance market are continuously seeking strategic partnerships, acquisitions, and collaborations to strengthen their market position and enhance their service offerings. The market is also witnessing a rise in demand for DO insurance from emerging economies, such as China and India, due to the increasing number of publicly listed companies and the growing awareness of corporate governance best practices.

Directors and Officers Insurance Market Segmentation Insights

-

Directors and Officers Insurance Market Coverage Outlook

-

Directors and Officers Liability Insurance

-

Employment Practices Liability Insurance

-

Fiduciary Liability Insurance

-

Crime Insurance

-

Directors and Officers Insurance Market Organization Size Outlook

-

Small and Medium-Sized Enterprises (SMEs)

-

Large Enterprises

-

Directors and Officers Insurance Market Industry Vertical Outlook

-

Financial Services

-

Healthcare

-

Technology

-

Manufacturing

-

Retail

-

Directors and Officers Insurance Market Regional Outlook

-

North America

-

Europe

-

South America

-

Asia Pacific

-

Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2023 |

21.1 (USD Billion) |

| Market Size 2024 |

22.09 (USD Billion) |

| Market Size 2032 |

36.6 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

6.5% (2024 - 2032) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2023 |

| Market Forecast Period |

2024 - 2032 |

| Historical Data |

2019 - 2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Lloyd's of London, Everest Re Group, Ltd., Munich Reinsurance America, Inc., Zurich Insurance Group Ltd., AXA SA, AIG, Liberty Mutual Insurance Group, Tokio Marine Holdings, Inc., Travelers Companies, Inc., Chubb Limited, Allianz SE, Marsh McLennan Companies, Inc., Berkshire Hathaway Specialty Insurance, CNA Financial Corporation, Swiss Reinsurance Company Ltd. |

| Segments Covered |

Coverage, Organization Size, Industry Vertical, Regional |

| Key Market Opportunities |

Increased regulatory scrutiny. Growing demand for cyber coverage. Rise of class action lawsuits. Expansion into emerging markets. Technological advancements. |

| Key Market Dynamics |

Increased regulatory scrutiny, Heightened risk awareness, Growing litigation and claims, Mergers and acquisitions activity, Cybersecurity threats |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ) :

The Global DO Insurance Market is anticipated to reach a value of USD 21.1 billion in 2023.

The Global DO Insurance Market is estimated to expand at a CAGR of 6.5% from 2024 to 2032.

Factors contributing to the market's growth include increasing regulatory scrutiny, rising litigation costs, and growing awareness of DO liability among corporate boards.

North America is anticipated to hold the largest market share in the Global DO Insurance Market in 2023.

DO Insurance is primarily used to protect Directors and Officers of companies against claims alleging breaches of their duties or responsibilities.

Major players in the Global DO Insurance Market include AIG, Chubb, Zurich Insurance Group, Berkshire Hathaway, and Allianz.

The Global DO Insurance Market is projected to reach a value of USD 21.05 billion by 2032.

Emerging trends include the rise of cyber risks, increased demand for specialized DO coverage, and the growing importance of environmental, social, and governance (ESG) factors.

Regulatory changes, such as increased enforcement of securities laws, are driving demand for DO Insurance.

Challenges include rising insurance costs, the potential for large claims, and the impact of economic downturns.