Global Economic Trends

The Liability Insurance Market is closely tied to prevailing economic trends, which influence the demand for insurance products. Economic growth typically correlates with increased business activity, leading to a higher incidence of liability exposures. As companies expand their operations, they often encounter new risks that necessitate adequate liability coverage. Conversely, economic downturns may result in reduced business activity, potentially impacting the demand for liability insurance. However, even in challenging economic climates, businesses recognize the necessity of protecting themselves against potential liabilities. Recent economic forecasts suggest a steady growth trajectory, which is likely to bolster the liability insurance market. Insurers are thus positioned to capitalize on this growth by offering products that align with the evolving needs of businesses in a dynamic economic environment.

Rising Litigation Rates

The Liability Insurance Market is experiencing a notable increase in litigation rates across various sectors. This trend is driven by heightened awareness of legal rights among consumers and businesses alike. As individuals become more informed about their rights, they are more likely to pursue legal action in cases of perceived negligence or harm. In recent years, the number of liability claims has surged, leading to a corresponding rise in demand for liability insurance products. According to industry reports, the frequency of claims has increased by approximately 5% annually, prompting insurers to adapt their offerings. This environment creates a robust market for liability insurance, as businesses seek to mitigate risks associated with potential lawsuits. Insurers are thus compelled to innovate and enhance their policy offerings to meet the evolving needs of their clients.

Evolving Business Models

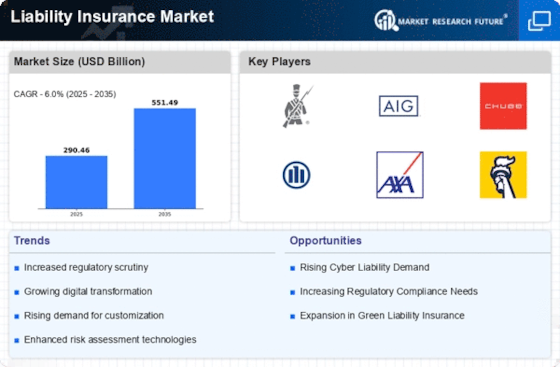

The Liability Insurance Market is significantly influenced by the evolution of business models, particularly in sectors such as technology and e-commerce. As companies adopt new operational frameworks, they face unique liability exposures that necessitate tailored insurance solutions. For instance, the rise of gig economy platforms has introduced complexities in liability coverage, as traditional policies may not adequately address the risks associated with independent contractors. This shift has led to an increased demand for specialized liability insurance products that cater to these emerging business models. Furthermore, the market is projected to grow at a compound annual growth rate of 6% over the next five years, driven by the need for businesses to protect themselves against potential liabilities. Insurers are thus focusing on developing innovative products that align with the changing landscape of business operations.

Increased Awareness of Risk Management

The Liability Insurance Market is witnessing a surge in awareness regarding risk management practices among businesses. Organizations are increasingly recognizing the importance of comprehensive liability coverage as part of their overall risk management strategy. This heightened awareness is largely attributed to the growing complexity of regulatory environments and the potential financial repercussions of liability claims. As a result, businesses are proactively seeking liability insurance to safeguard their assets and ensure compliance with legal requirements. Recent surveys indicate that approximately 70% of businesses now prioritize liability insurance as a critical component of their risk management framework. This trend is likely to bolster the demand for liability insurance products, as companies strive to mitigate risks and protect their financial interests in an increasingly litigious environment.

Technological Advancements in Underwriting

The Liability Insurance Market is being transformed by technological advancements that enhance underwriting processes. Insurers are increasingly leveraging data analytics, artificial intelligence, and machine learning to assess risks more accurately and efficiently. These technologies enable insurers to analyze vast amounts of data, leading to more precise pricing and tailored policy offerings. As a result, the underwriting process becomes more streamlined, allowing insurers to respond swiftly to market demands. This shift not only improves operational efficiency but also enhances customer satisfaction, as businesses receive more personalized insurance solutions. The integration of technology in underwriting is expected to drive growth in the liability insurance sector, with projections indicating a potential increase in market size by 8% over the next few years. Insurers that embrace these innovations are likely to gain a competitive edge in the evolving landscape.