Evolving Consumer Expectations

Consumer expectations are evolving, prompting the Specialty Insurance Market to innovate and enhance service delivery. Clients now demand personalized insurance solutions that cater to their specific needs, which has led to the development of customized policies. Insurers are leveraging data analytics to better understand client preferences and risk profiles, allowing for more tailored offerings. This trend is particularly evident in sectors such as travel and event insurance, where clients seek coverage that aligns with their unique circumstances. As a result, companies that can effectively respond to these changing expectations are likely to gain a competitive edge in the Specialty Insurance Market.

Rising Awareness of Emerging Risks

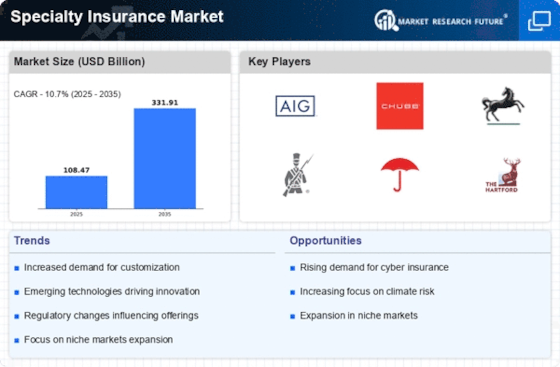

There is a rising awareness of emerging risks among businesses, which is driving growth in the Specialty Insurance Market. As organizations face new challenges such as climate change, cyber threats, and geopolitical instability, the demand for specialized insurance products that address these risks is increasing. For example, the market for environmental liability insurance has seen a notable uptick as companies seek to mitigate potential environmental impacts. This heightened awareness suggests that businesses are becoming more proactive in managing risks, leading to a greater reliance on specialty insurers to provide tailored solutions. Consequently, the Specialty Insurance Market is likely to expand as insurers develop innovative products to meet these evolving needs.

Increased Demand for Niche Coverage

The Specialty Insurance Market experiences heightened demand for niche coverage options as businesses seek to protect unique assets and operations. This trend is driven by the growing complexity of risks associated with specialized industries such as technology, healthcare, and renewable energy. For instance, the market for cyber insurance has expanded significantly, with estimates suggesting a growth rate of over 20% annually. As companies increasingly rely on digital infrastructure, the need for tailored insurance solutions becomes paramount. This shift indicates that insurers must adapt their offerings to meet the specific needs of diverse sectors, thereby enhancing their competitive positioning within the Specialty Insurance Market.

Regulatory Changes and Compliance Needs

The Specialty Insurance Market is significantly influenced by regulatory changes and the need for compliance. As governments implement new regulations to address emerging risks, insurers must adapt their policies and practices accordingly. This is particularly evident in sectors such as environmental and liability insurance, where regulatory frameworks are becoming increasingly stringent. Insurers that proactively align their offerings with these regulations are likely to enhance their market position and mitigate potential liabilities. Furthermore, the complexity of compliance requirements may drive demand for specialized insurance products that cater to specific regulatory needs, thereby creating opportunities for growth within the Specialty Insurance Market.

Technological Advancements in Underwriting

Technological advancements are reshaping the underwriting processes within the Specialty Insurance Market. The integration of artificial intelligence and machine learning enables insurers to analyze vast amounts of data more efficiently, leading to improved risk assessment and pricing strategies. This transformation is particularly relevant in sectors such as marine and aviation insurance, where complex risk factors are prevalent. By adopting these technologies, insurers can streamline operations, reduce costs, and enhance customer satisfaction. The ongoing evolution of technology suggests that the Specialty Insurance Market will continue to see significant changes in how underwriting is conducted, potentially leading to more competitive pricing and better coverage options.