Market Trends

Key Emerging Trends in the Digital Workspace Market

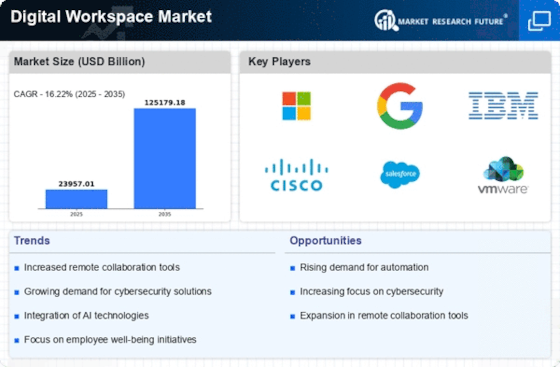

The digital workspace market is undergoing rapid evolution and transformation, driven by the increasing adoption of remote work, digital collaboration tools, and cloud-based technologies. A digital workspace encompasses a suite of software applications, communication tools, and productivity solutions that enable employees to access corporate resources, collaborate with colleagues, and perform their tasks from anywhere, using any device. As we explore the market trends of the digital workspace, several key factors emerge that are shaping its trajectory.

One prominent trend in the digital workspace market is the rising demand for flexible and agile work environments, fueled by the shift towards remote and hybrid work models. With the COVID-19 pandemic reshaping the way organizations operate and employees work, there is a growing need for digital solutions that facilitate seamless remote collaboration, communication, and productivity. Digital workspace platforms that offer features such as virtual desktop infrastructure (VDI), unified communication and collaboration (UCC), and secure remote access are in high demand, enabling businesses to support remote workforces effectively and maintain business continuity in a distributed work environment.

Moreover, the convergence of technologies such as cloud computing, artificial intelligence (AI), and mobile computing is driving innovation in the digital workspace market, enabling organizations to deliver personalized, context-aware experiences to employees. Cloud-based digital workspace solutions offer scalability, flexibility, and cost-effectiveness, allowing organizations to deploy and manage virtual desktops, applications, and data from centralized platforms. AI-powered analytics and automation capabilities enhance user experience, optimize resource utilization, and provide insights into user behavior and productivity patterns, enabling organizations to make data-driven decisions and improve operational efficiency.

Another significant trend shaping the digital workspace market is the increasing focus on cybersecurity and data protection in light of growing cyber threats and regulatory compliance requirements. As organizations embrace digital transformation and adopt cloud-based collaboration tools and mobile devices, they are faced with new security challenges related to data privacy, identity management, and endpoint security. Digital workspace providers are integrating advanced security features such as multifactor authentication (MFA), data encryption, and endpoint detection and response (EDR) into their platforms to safeguard sensitive information, prevent unauthorized access, and mitigate the risk of data breaches and cyber attacks.

Furthermore, the digital workspace market is witnessing a shift towards integrated, all-in-one solutions that consolidate disparate tools and applications into unified platforms, streamlining user experience and enhancing productivity. Modern digital workspace platforms offer seamless integration with third-party applications, business systems, and cloud services, enabling users to access and collaborate on documents, emails, calendars, and other resources from a single interface. By eliminating silos, reducing complexity, and improving interoperability, integrated digital workspace solutions empower employees to work more efficiently, collaborate more effectively, and adapt to changing work environments and business requirements.

Additionally, the COVID-19 pandemic has accelerated the adoption of digital workspace solutions as organizations seek to enable remote work, support distributed teams, and enhance employee productivity and engagement. With the shift towards remote and hybrid work models expected to persist in the post-pandemic era, the demand for digital workspace technologies that enable flexible work arrangements, virtual collaboration, and secure remote access is poised to continue growing. As organizations navigate the challenges of remote work and digital transformation, digital workspace providers are innovating and evolving their offerings to meet the evolving needs of customers and address emerging trends in the digital workplace.

Leave a Comment