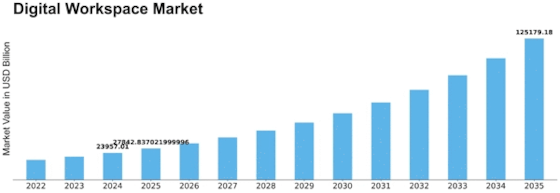

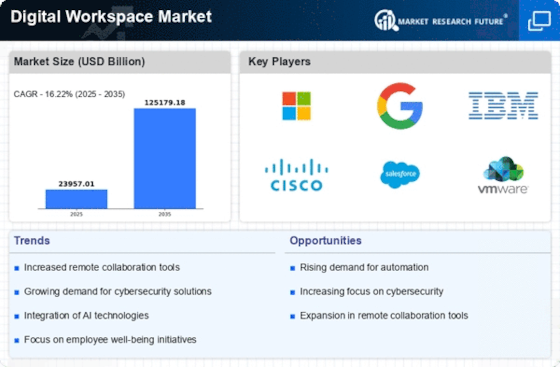

Digital Workspace Size

Digital Workspace Market Growth Projections and Opportunities

The digital workspace market is shaped by several key factors that influence its growth and trajectory. One critical factor is the rapid evolution of technology. As digital transformation initiatives continue to reshape the modern workplace, there is a growing demand for solutions that enable remote work, collaboration, and productivity across various devices and platforms. Advances in cloud computing, mobile technology, and collaboration tools have fueled the adoption of digital workspace solutions, driving market growth. Organizations seek to leverage these technologies to create flexible, agile work environments that empower employees to work anytime, anywhere, and on any device.

Moreover, changing workforce dynamics play a significant role in shaping the digital workspace market. The rise of remote work, freelance gigs, and the gig economy has transformed traditional notions of the workplace. Organizations are increasingly embracing flexible work arrangements to attract and retain top talent, reduce overhead costs, and improve employee satisfaction. As a result, there is a growing demand for digital workspace solutions that enable seamless collaboration, communication, and access to resources regardless of location or device. Solutions that offer features such as virtual desktop infrastructure (VDI), mobile device management (MDM), and secure remote access are particularly sought after in today's distributed work environment.

Furthermore, cybersecurity concerns influence the digital workspace market landscape. With the proliferation of remote work and cloud-based applications, organizations face an array of cybersecurity threats, including data breaches, ransomware attacks, and insider threats. Protecting sensitive information and intellectual property in the digital workspace requires robust security measures, including encryption, multi-factor authentication, endpoint security, and secure access controls. As a result, organizations are increasingly investing in digital workspace solutions that prioritize security and compliance to mitigate cyber risks and safeguard their digital assets.

Regulatory compliance requirements also drive demand for digital workspace solutions. Governments around the world impose strict regulations and standards aimed at protecting data privacy, ensuring regulatory compliance, and safeguarding sensitive information. Compliance with regulations such as GDPR, HIPAA, and PCI DSS requires organizations to implement comprehensive security measures and data protection protocols in their digital workspace environments. As a result, there is a growing need for digital workspace solutions that offer built-in compliance features, audit trails, and data governance capabilities to help organizations meet regulatory requirements and avoid costly penalties.

Additionally, the COVID-19 pandemic has accelerated the adoption of digital workspace solutions. The sudden shift to remote work and the need for business continuity amid lockdowns and social distancing measures have underscored the importance of digital technologies in enabling remote collaboration and productivity. Organizations have had to rapidly deploy digital workspace solutions to support remote workforces, facilitate virtual collaboration, and ensure operational continuity. This unprecedented demand for digital workspace solutions is expected to continue as organizations embrace hybrid work models and prioritize flexibility and resilience in their workplace strategies.

Competitive pressures also influence the digital workspace market landscape. The market is highly competitive, with numerous vendors offering a wide range of digital workspace solutions, including virtual desktop infrastructure (VDI), workspace as a service (WaaS), unified endpoint management (UEM), and collaboration platforms. Factors such as product features, performance, scalability, pricing, and customer support influence purchasing decisions. Vendors must differentiate their offerings through innovation, integration with existing systems, and value-added services to gain a competitive edge in the market. Additionally, strategic partnerships, mergers, and acquisitions can reshape the competitive landscape and drive market consolidation.

Leave a Comment