Market Analysis

In-depth Analysis of Digital Workspace Market Industry Landscape

The market dynamics of the digital workspace are shaped by various factors that influence supply, demand, and overall industry trends. One significant driver of this market is the increasing adoption of remote work and hybrid work models by organizations worldwide. With the proliferation of digital technologies and the growing trend towards flexible work arrangements, there is a growing need for digital workspace solutions that enable employees to access applications, data, and collaboration tools from any location and device, driving demand for these solutions.

Technological advancements play a crucial role in driving the market dynamics of the digital workspace. As cloud computing, mobile technology, virtualization, and collaboration tools evolve, digital workspace providers are continually innovating to deliver more seamless, secure, and user-friendly experiences for employees. This includes the development of unified communication and collaboration (UCC) platforms, virtual desktop infrastructure (VDI) solutions, identity and access management (IAM) tools, and endpoint security solutions to enhance productivity, connectivity, and data protection in the digital workplace.

Another factor influencing market dynamics is the increasing focus on employee experience and productivity. As organizations seek to attract and retain top talent in a competitive labor market, they are investing in digital workspace solutions that empower employees to work more efficiently, collaborate effectively, and maintain work-life balance. User-centric design, personalized experiences, and intuitive interfaces are becoming essential features of digital workspace solutions as organizations prioritize employee satisfaction and engagement.

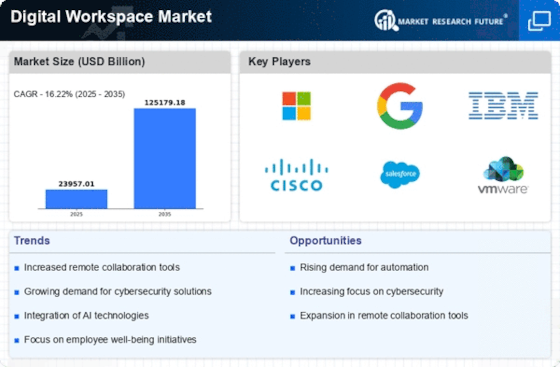

The competitive landscape also plays a significant role in shaping market dynamics. Major players in the industry, including companies like Microsoft, VMware, Citrix Systems, Google, and Slack, compete for market share by offering a wide range of digital workspace solutions with different features, capabilities, and pricing models. Competition among providers drives continuous innovation in product development, customer service, and pricing strategies, benefiting organizations with a variety of options to choose from.

Additionally, market dynamics are influenced by regulatory requirements and compliance standards. Organizations must ensure that their digital workspace solutions comply with data privacy regulations such as GDPR (General Data Protection Regulation) and industry-specific compliance requirements such as HIPAA (Health Insurance Portability and Accountability Act) for healthcare organizations. Compliance with security standards such as ISO 27001 and SOC 2 is also essential for ensuring the confidentiality, integrity, and availability of data in the digital workspace.

Economic factors also impact the market dynamics of the digital workspace. Budget constraints, cost considerations, and return on investment (ROI) calculations may influence purchasing decisions among organizations, especially in industries facing financial challenges or market uncertainties. Digital workspace providers may offer flexible pricing models, subscription-based licensing, and cost-effective deployment options to accommodate the budgetary needs of organizations and drive adoption of their solutions.

Furthermore, market dynamics are shaped by emerging trends and technologies in the digital workspace industry. Trends such as the rise of remote work, bring-your-own-device (BYOD) policies, and the Internet of Things (IoT) are driving demand for digital workspace solutions that enable secure access to corporate resources from any device, anywhere. Other trends, such as the integration of artificial intelligence (AI) and machine learning (ML) capabilities into digital workspace platforms, are reshaping the way organizations manage and optimize their digital workplace environments.

Leave a Comment