Expansion of Retail and Hospitality Sectors

The Digital Signage Market is experiencing expansion driven by the retail and hospitality sectors. These industries increasingly adopt digital signage to enhance customer experiences and streamline operations. In retail, digital displays are utilized for promotions, product information, and interactive experiences, which can lead to increased sales. The hospitality sector employs digital signage for wayfinding, event information, and guest services, improving overall customer satisfaction. As of 2025, the retail digital signage market is projected to grow at a CAGR of 8.2%, indicating a robust demand for innovative solutions that cater to the evolving needs of consumers in these sectors.

Increased Adoption in Corporate Communication

The Digital Signage Market sees increased adoption in corporate communication as organizations recognize the benefits of digital displays for internal messaging. Companies utilize digital signage to convey important announcements, training materials, and performance metrics in real-time. This shift towards digital communication enhances information dissemination and fosters a more connected workplace. As of 2025, the corporate digital signage market is anticipated to grow significantly, reflecting a broader trend towards digital transformation in business operations. The ability to customize content and target specific audiences within the organization further underscores the value of digital signage in enhancing corporate communication strategies.

Rising Demand for Enhanced Customer Engagement

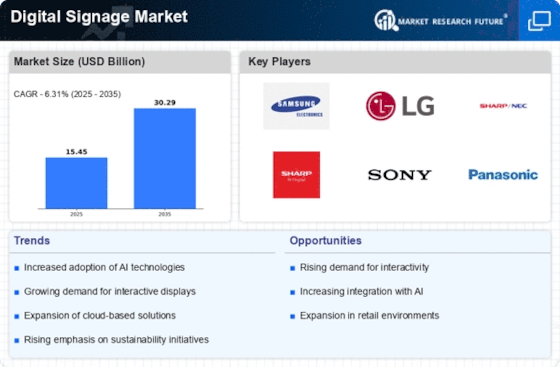

The Digital Signage Market experiences a notable surge in demand for solutions that enhance customer engagement. Businesses increasingly recognize the value of interactive displays and dynamic content in capturing consumer attention. According to recent data, the market for digital signage is projected to reach USD 31.71 billion by 2026, driven by the need for more personalized and engaging customer experiences. Retailers, in particular, leverage digital signage to create immersive shopping environments, thereby increasing foot traffic and sales. This trend indicates a shift towards more innovative marketing strategies, where digital signage plays a pivotal role in influencing consumer behavior and driving brand loyalty.

Technological Advancements in Display Solutions

Technological advancements significantly influence the Digital Signage Market, particularly in display solutions. Innovations such as OLED and 4K resolution displays enhance visual quality, making digital signage more appealing to consumers. The integration of cloud-based technologies allows for real-time content updates and remote management, streamlining operations for businesses. As of 2025, the market for digital signage hardware is expected to grow, with a compound annual growth rate (CAGR) of approximately 7.5%. This growth is indicative of the increasing reliance on high-quality visual displays to convey messages effectively, thereby enhancing the overall impact of digital signage in various sectors.

Growth of Smart Cities and Infrastructure Development

The Digital Signage Market is poised for growth due to the expansion of smart cities and infrastructure development. As urban areas evolve, the need for efficient communication systems becomes paramount. Digital signage serves as a vital tool for disseminating information in public spaces, such as transportation hubs and city centers. The increasing investment in smart city initiatives, which often includes digital signage solutions, is expected to drive market growth. By 2025, the smart city market is projected to reach USD 2.57 trillion, with digital signage playing a crucial role in enhancing urban living through improved information accessibility and public engagement.