Expansion of Smart Cities

The digital signage market in APAC is significantly influenced by the ongoing development of smart cities. As urban areas increasingly adopt advanced technologies to improve infrastructure and services, digital signage plays a crucial role in enhancing communication and information flow. Smart city initiatives often incorporate digital displays for public announcements, traffic management, and advertising, thereby creating a more connected urban environment. Reports indicate that investments in smart city projects in APAC are expected to reach $1 trillion by 2025, which will likely drive the demand for digital signage solutions. The integration of digital signage within smart city frameworks not only improves public engagement but also supports the digital signage market by fostering innovation and technological advancements.

Increased Focus on Customer Experience

The digital signage market in APAC is increasingly driven by a heightened focus on customer experience. Businesses are recognizing the importance of engaging customers through visually appealing and interactive displays. Retailers, in particular, are leveraging digital signage to create immersive shopping experiences that attract and retain customers. Studies indicate that effective digital signage can increase customer dwell time by up to 30%, leading to higher sales conversions. This trend is prompting companies to invest in advanced digital signage solutions that enhance the overall customer journey. As the digital signage market evolves, the emphasis on customer experience is likely to remain a key driver, pushing businesses to innovate and adopt more engaging content strategies.

Growing Demand for Real-Time Information

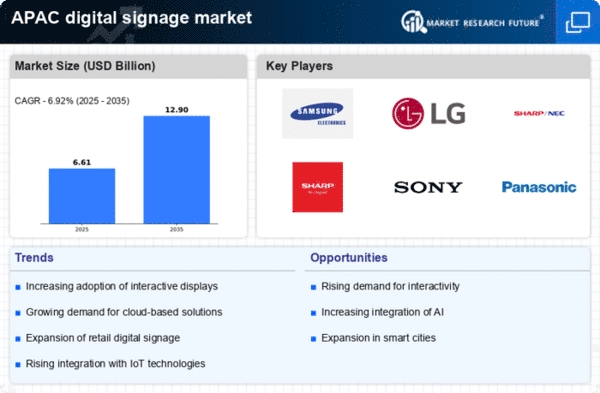

The digital signage market in APAC experiences a notable surge in demand for real-time information dissemination. Businesses across various sectors, including retail, transportation, and hospitality, increasingly rely on digital signage to provide timely updates and engage customers effectively. For instance, the transportation sector utilizes digital displays to convey real-time travel information, enhancing passenger experience. According to recent data, the market for digital signage in APAC is projected to grow at a CAGR of approximately 10% from 2025 to 2030. This growth is driven by the need for dynamic content that can be updated instantly, allowing organizations to respond swiftly to changing circumstances. Consequently, the digital signage market is poised to expand as more companies recognize the value of real-time communication in enhancing customer engagement and operational efficiency.

Rising Adoption of Cloud-Based Solutions

The digital signage market in APAC is witnessing a shift towards cloud-based solutions, which offer enhanced flexibility and scalability for businesses. Organizations are increasingly adopting cloud technology to manage their digital signage networks, allowing for centralized control and easier content updates. This trend is particularly beneficial for companies with multiple locations, as it simplifies the management of diverse content across various displays. Data suggests that the cloud-based digital signage segment is expected to grow at a CAGR of around 15% in the coming years. This growth indicates a strong preference for solutions that reduce operational costs and improve efficiency. As a result, the digital signage market is likely to benefit from the increasing reliance on cloud technology, enabling businesses to optimize their digital signage strategies.

Technological Advancements in Display Technologies

The digital signage market in APAC is significantly impacted by rapid technological advancements in display technologies. Innovations such as OLED, LED, and 4K resolution displays are transforming the landscape of digital signage, offering superior image quality and energy efficiency. These advancements enable businesses to create more captivating and visually striking content, which is essential for capturing audience attention. The market for advanced display technologies is projected to grow substantially, with estimates suggesting a CAGR of around 12% over the next few years. This growth is indicative of the increasing demand for high-quality visual experiences in various sectors, including retail, entertainment, and corporate environments. Consequently, the digital signage market is likely to thrive as companies adopt cutting-edge display technologies to enhance their communication strategies.