Military and Defense Applications

The military and defense sectors are pivotal to the Digital Radar Market, as nations invest heavily in advanced radar technologies for surveillance and reconnaissance. The increasing geopolitical tensions and the need for enhanced situational awareness are driving demand for sophisticated radar systems. Recent data suggests that defense spending on radar technologies is projected to increase by 5% annually, reflecting the strategic importance of these systems. Digital radar solutions are being integrated into various platforms, including unmanned aerial vehicles (UAVs) and naval vessels, further solidifying their role in modern defense strategies.

Growing Demand in Automotive Sector

The automotive sector is a significant driver for the Digital Radar Market, particularly with the rise of advanced driver-assistance systems (ADAS). As vehicles become more automated, the demand for radar systems that facilitate features such as adaptive cruise control and collision avoidance is surging. Recent statistics indicate that the automotive radar market is expected to grow at a CAGR of 15% over the next five years, highlighting the increasing integration of radar technology in vehicles. This trend is further supported by regulatory mandates for safety features, which are likely to propel the adoption of digital radar systems in the automotive industry.

Focus on Environmental Sustainability

The Digital Radar Market is increasingly influenced by a focus on environmental sustainability. As industries strive to reduce their carbon footprint, radar technologies are being utilized for efficient resource management and monitoring. For example, digital radar systems are employed in environmental monitoring to track wildlife and assess habitat changes, contributing to conservation efforts. Furthermore, the use of radar in renewable energy applications, such as wind farm monitoring, is gaining traction. This shift towards sustainable practices is expected to create new opportunities for growth within the digital radar market, as organizations seek innovative solutions to meet environmental goals.

Technological Advancements in Digital Radar

The Digital Radar Market is experiencing rapid technological advancements that enhance radar capabilities. Innovations such as phased array technology and advanced signal processing algorithms are improving detection accuracy and range. These advancements are crucial for applications in defense, aviation, and automotive sectors. For instance, the integration of artificial intelligence in radar systems is enabling real-time data analysis, which is expected to drive market growth. According to recent data, the market for digital radar systems is projected to reach USD 10 billion by 2026, reflecting a compound annual growth rate of approximately 7.5%. This growth is indicative of the increasing reliance on sophisticated radar technologies across various industries.

Emerging Markets and Infrastructure Development

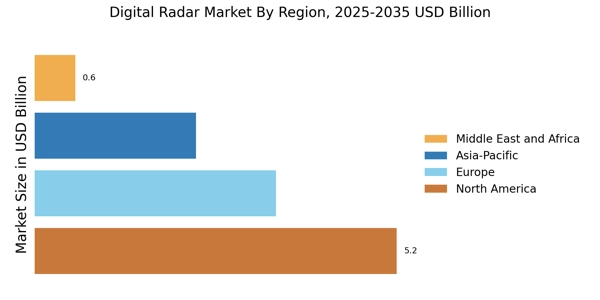

Emerging markets are becoming increasingly relevant to the Digital Radar Market, driven by rapid infrastructure development and urbanization. Countries investing in smart city initiatives are incorporating radar technologies for traffic management, security, and environmental monitoring. The demand for digital radar systems in these regions is expected to grow as governments prioritize modernization and efficiency. Market analysis indicates that infrastructure projects in Asia and Africa could lead to a 10% increase in radar system adoption over the next few years, highlighting the potential for growth in these developing economies.