Market Growth Projections

The Global Military Airborne Radar Industry is projected to experience substantial growth over the next decade. With a market value of 2.69 USD Billion in 2024, it is expected to reach 5.22 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 6.22% from 2025 to 2035. Factors contributing to this growth include technological advancements, increasing defense budgets, and rising geopolitical tensions. The market's expansion reflects the critical role of airborne radar systems in modern military operations, highlighting the ongoing demand for enhanced surveillance and reconnaissance capabilities.

Increasing Defense Budgets

Globally, defense budgets are on the rise, which is a critical driver for the Global Military Airborne Radar Industry. Countries are allocating more resources to enhance their military capabilities, including airborne radar systems. For example, nations like the United States and China are investing heavily in upgrading their military fleets, which includes advanced radar technologies. This increase in defense spending is projected to contribute to the market's growth, with estimates suggesting it could reach 5.22 USD Billion by 2035. The compound annual growth rate of 6.22% from 2025 to 2035 indicates a robust demand for these systems.

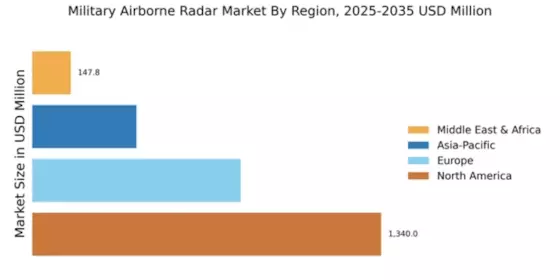

Emerging Markets and Defense Modernization

Emerging markets are increasingly focusing on defense modernization, which significantly impacts the Global Military Airborne Radar Industry. Countries in Asia-Pacific and the Middle East are investing in upgrading their military technologies, including airborne radar systems. For instance, nations like India and Saudi Arabia are enhancing their defense capabilities to address regional security challenges. This modernization trend is likely to drive demand for advanced radar systems, as these countries seek to bolster their military readiness. The anticipated growth in these markets is expected to contribute to the overall expansion of the industry.

Geopolitical Tensions and Security Concerns

Geopolitical tensions and security concerns are pivotal factors influencing the Global Military Airborne Radar Industry. As nations face increasing threats from regional conflicts and terrorism, there is a heightened need for advanced surveillance and reconnaissance capabilities. Countries are prioritizing the development and acquisition of airborne radar systems to enhance situational awareness and response times. This trend is evident in various military exercises and operations that emphasize the importance of radar technology. The ongoing conflicts in various regions underscore the necessity for robust military capabilities, further propelling market growth.

Technological Advancements in Radar Systems

The Global Military Airborne Radar Industry is experiencing a surge in technological advancements, particularly in radar systems. Innovations such as phased array radar and synthetic aperture radar are enhancing detection capabilities and target tracking. For instance, the integration of artificial intelligence and machine learning algorithms is improving the accuracy and efficiency of radar systems. This trend is expected to drive the market significantly, as nations invest in modernizing their military capabilities. The market is projected to reach 2.69 USD Billion in 2024, reflecting a growing emphasis on advanced radar technologies.

Integration of Unmanned Aerial Vehicles (UAVs)

The integration of unmanned aerial vehicles (UAVs) into military operations is reshaping the Global Military Airborne Radar Industry. UAVs equipped with advanced radar systems are enhancing reconnaissance and surveillance capabilities, providing real-time data to military commanders. This integration allows for more efficient operations and improved situational awareness. As military forces worldwide adopt UAV technology, the demand for airborne radar systems that can operate in conjunction with these platforms is likely to increase. This trend reflects a broader shift towards modern warfare tactics, emphasizing the importance of radar systems in contemporary military strategies.