Rise of Autonomous Vehicles

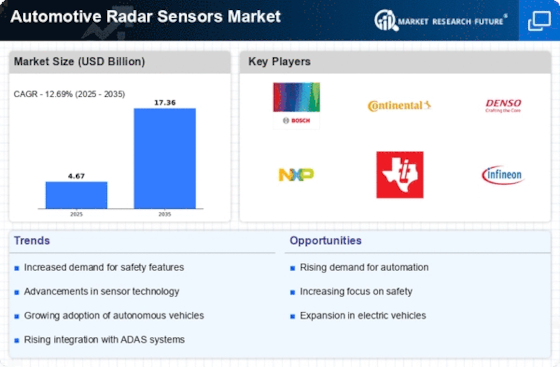

The Automotive Radar Sensors Market is poised for growth due to the rise of autonomous vehicles. As the automotive sector shifts towards automation, the demand for sophisticated radar sensors is expected to increase. These sensors play a crucial role in enabling vehicles to perceive their surroundings accurately, which is essential for safe navigation. Market data suggests that the autonomous vehicle segment is projected to witness substantial growth, with radar sensors being integral to the development of Level 3 and Level 4 automation. This trend indicates a robust future for the Automotive Radar Sensors Market, as manufacturers invest in technology to enhance vehicle autonomy.

Expansion of Electric Vehicles

The expansion of electric vehicles (EVs) is contributing to the growth of the Automotive Radar Sensors Market. As the EV market continues to gain traction, manufacturers are increasingly incorporating advanced radar sensors to enhance the safety and functionality of these vehicles. The integration of radar technology in EVs not only supports safety features but also aids in optimizing battery performance through efficient energy management systems. Market projections indicate that the EV segment will significantly influence the Automotive Radar Sensors Market, as the demand for innovative safety solutions in electric vehicles continues to rise.

Increasing Regulatory Standards

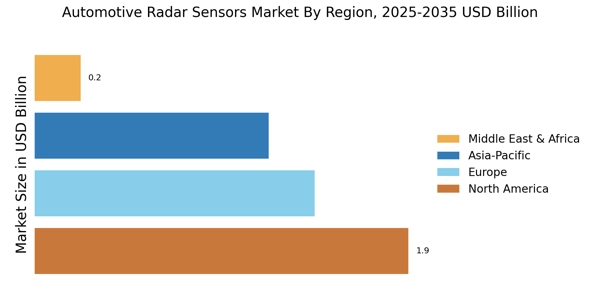

The Automotive Radar Sensors Market is being shaped by increasing regulatory standards aimed at improving vehicle safety. Governments worldwide are implementing stringent regulations that mandate the inclusion of advanced safety features in new vehicles. This regulatory push is compelling manufacturers to invest in radar sensor technology to comply with safety requirements. Data suggests that regions with strict automotive safety regulations are witnessing a faster adoption of radar systems. As compliance becomes a priority, the Automotive Radar Sensors Market is expected to expand, driven by the need for manufacturers to meet these evolving standards and enhance vehicle safety.

Growing Demand for Safety Features

The Automotive Radar Sensors Market is experiencing a notable surge in demand for enhanced safety features in vehicles. As consumers become increasingly aware of road safety, manufacturers are compelled to integrate advanced radar sensors into their vehicles. This trend is further supported by data indicating that vehicles equipped with radar-based safety systems can reduce accident rates significantly. The integration of these sensors not only aids in collision avoidance but also enhances functionalities such as adaptive cruise control and lane-keeping assistance. Consequently, the growing emphasis on safety is driving the Automotive Radar Sensors Market, as automakers strive to meet consumer expectations and regulatory standards.

Technological Innovations in Radar Systems

Technological innovations are significantly influencing the Automotive Radar Sensors Market. Recent advancements in radar technology, such as the development of millimeter-wave radar, have enhanced the performance and reliability of these sensors. These innovations allow for improved detection capabilities, even in challenging weather conditions. Market analysis indicates that the introduction of solid-state radar systems is expected to further propel the industry, as these systems offer greater durability and lower production costs. As manufacturers adopt these cutting-edge technologies, the Automotive Radar Sensors Market is likely to experience accelerated growth, driven by the demand for more efficient and effective radar solutions.