Expansion of Electric Vehicle Market

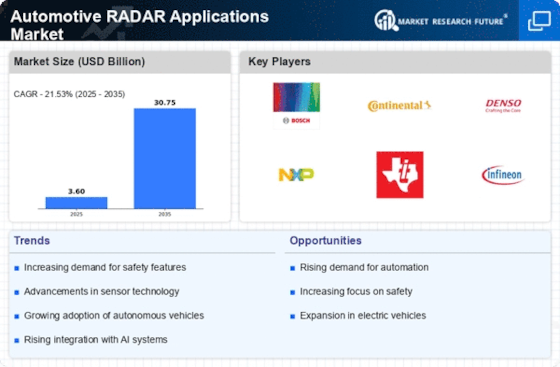

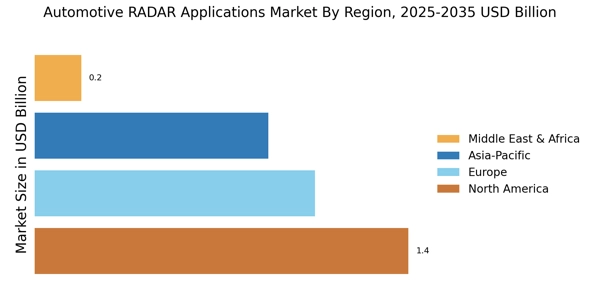

The expansion of the electric vehicle market is emerging as a key driver for the Automotive RADAR Applications Market. As the adoption of electric vehicles (EVs) continues to rise, manufacturers are increasingly incorporating advanced technologies to enhance the functionality and safety of these vehicles. RADAR systems are essential for various EV applications, including adaptive cruise control and automated parking, which are critical for improving user experience. Recent statistics indicate that the EV market is expected to grow at a compound annual growth rate of over 25% in the coming years. This growth presents a substantial opportunity for the Automotive RADAR Applications Market, as the integration of RADAR technology into EVs not only enhances safety but also supports the development of autonomous driving features, thereby aligning with the broader trends in the automotive sector.

Growth of Connected Vehicle Technologies

The growth of connected vehicle technologies is a significant driver for the Automotive RADAR Applications Market. As vehicles become increasingly interconnected, the need for reliable and accurate sensing technologies, such as RADAR, becomes paramount. Connected vehicles rely on real-time data exchange to enhance navigation, safety, and overall driving experience. RADAR systems play a crucial role in this ecosystem by providing essential data for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications. The integration of RADAR with connected technologies is expected to enhance situational awareness and improve traffic management. Consequently, the Automotive RADAR Applications Market is likely to benefit from this trend, as manufacturers seek to develop vehicles that are not only safe but also capable of communicating with their environment, thereby improving overall road safety and efficiency.

Technological Advancements in RADAR Systems

Technological advancements are playing a pivotal role in shaping the Automotive RADAR Applications Market. Innovations in RADAR technology, such as the development of higher frequency bands and improved signal processing algorithms, are enhancing the performance and reliability of RADAR systems. These advancements enable vehicles to detect objects with greater accuracy and at longer ranges, which is crucial for the implementation of safety features and autonomous driving capabilities. Furthermore, the integration of machine learning and artificial intelligence with RADAR systems is expected to revolutionize the way vehicles interpret data from their surroundings. As a result, the Automotive RADAR Applications Market is likely to witness a significant uptick in the adoption of these advanced systems, as manufacturers seek to leverage cutting-edge technology to differentiate their offerings in a competitive landscape.

Increasing Regulatory Pressure for Safety Standards

The Automotive RADAR Applications Market is significantly influenced by increasing regulatory pressure for enhanced safety standards. Governments and regulatory bodies worldwide are implementing stringent safety regulations that mandate the inclusion of advanced safety features in new vehicles. For instance, the European Union has proposed regulations that require all new vehicles to be equipped with certain ADAS functionalities by 2024. This regulatory landscape is compelling automotive manufacturers to invest in RADAR technologies that comply with these standards. As a result, the demand for RADAR systems is expected to rise, as they are integral to meeting these safety requirements. The Automotive RADAR Applications Market is thus likely to expand as manufacturers prioritize compliance and consumer safety, driving innovation and investment in RADAR technologies.

Rising Demand for Advanced Driver Assistance Systems

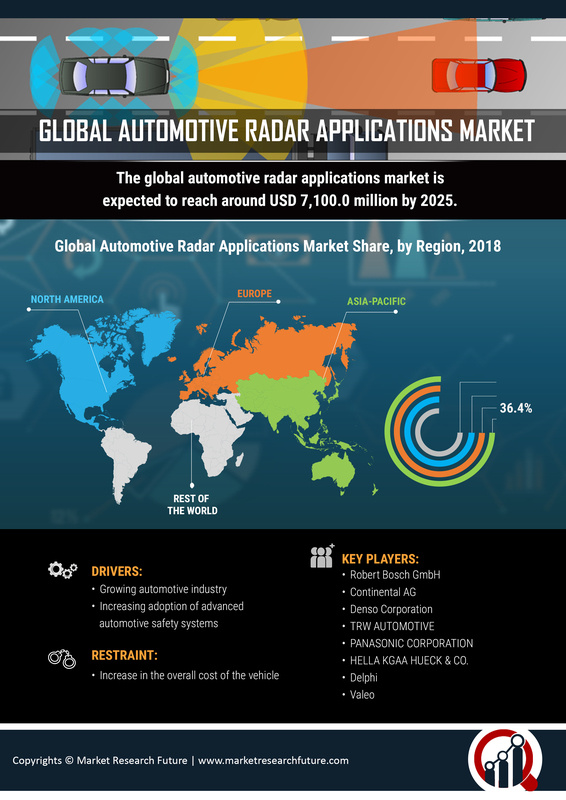

The Automotive RADAR Applications Market is experiencing a notable surge in demand for Advanced Driver Assistance Systems (ADAS). This trend is largely driven by the increasing emphasis on vehicle safety and the need to mitigate road accidents. According to recent data, the ADAS segment is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is indicative of a broader shift towards integrating sophisticated technologies that enhance driver awareness and vehicle control. As manufacturers strive to meet regulatory requirements and consumer expectations, the incorporation of RADAR technology into ADAS is becoming essential. Consequently, the Automotive RADAR Applications Market is poised to benefit significantly from this rising demand, as RADAR systems provide critical functionalities such as collision avoidance, lane-keeping assistance, and adaptive cruise control.