Delivery Robots Size

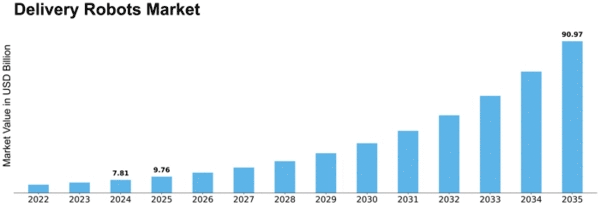

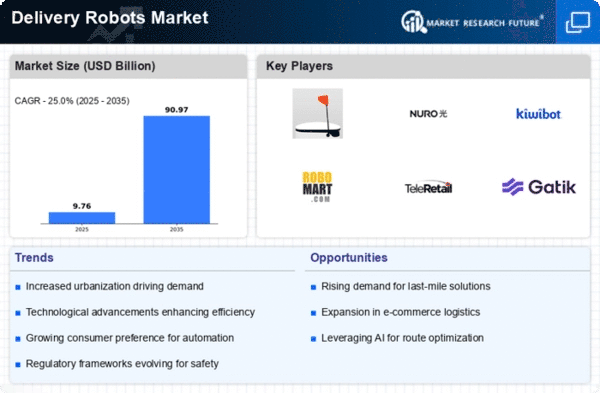

Delivery Robots Market Growth Projections and Opportunities

Several things in the market help deliver robots grow and change. This makes it a changing part of logistics for moving goods online. E-commerce activities are growing very fast and they are a big reason for market growth. More and more people are shopping online, so there is a big need for quick delivery to the last stop. Delivery robots can move around cities fast and bring packages quickly. They help businesses improve the way they send things out, which is important for staying ahead in online shopping world where competition is tough. Technology improvements are a key market factor, changing the abilities and features of delivery robots. As robotics, artificial intelligence and sensor tech keep getting better, delivery robots are becoming smarter too. Big sensors help with accurate travel, making sure safe and good deliveries happen in many places. Machines learn from artificial intelligence which make their choices better. This helps robots adjust to new situations and improve ways they deliver things. These computer parts help make delivery robots work better and do their job well. This makes them more attractive to businesses that want newfangled technology solutions. The market cares a lot about saving money, and delivery robots can help lower costs. This makes them an attractive choice for businesses. By using machines to do the final step of delivering goods, companies can make their shipping work more efficient. This cuts down on manual labor and cost related to it. The cost to start using robots can be big but in the long run, businesses save money on workers and get better at doing things. This makes delivery robots a smart choice for companies who want more profits or stay ahead of others selling stuff. The rules and regulations are very important for how the delivery robots market grows or changes. Rules and policies made by the government affect how self-driving robots are used in open places. Finding the right mix of new ideas and safety, rules make guidelines for how delivery bots are made, tested and used. As government rules change with the growth of self-driving technology, following set laws becomes very important to businesses. This affects how fast and far they use this new tech in their market activities.

Leave a Comment