Market Trends

Key Emerging Trends in the Delivery Robots Market

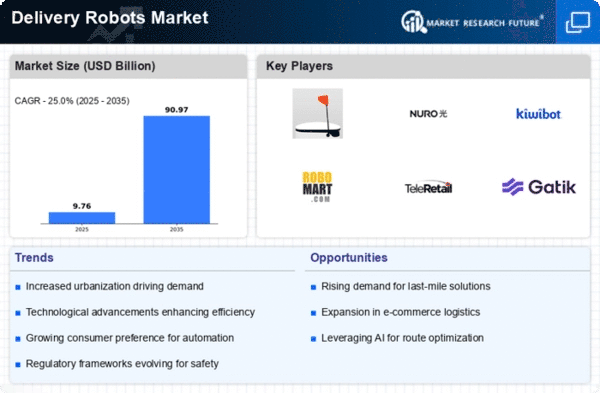

The Market for Delivery Robots is now booming with trends that show the changing state of logistics and online shopping. A major development is paying more attention to self-driving and smart technology. Now, delivery robots can run with modern sensors and computer learning skills. This lets them go through hard city areas without hitting things or missing deliveries. This change not only makes the final delivery stage more effective, it also helps to make sure that deliveries are safe and reliable in general. Another important pattern in the market is combining robotics with other new technologies like 5G connection and edge computing. These improvements allow real-time talking and data sorting, making the reaction speed and powers of delivery robots better. Sharing information between robots and big systems helps plan routes better, makes decisions easier, and lets remote watching of many robot groups. This pattern matches the bigger trend towards a more connected and digital supply chain. The market is also seeing a change to robot designs that can be built and arranged in different ways. This style meets the different needs of businesses working in many fields. Businesses can now select or make their own delivery robots according to what they need. This could be for sending food, delivering packages, or giving medical supplies. This flexibility lets companies change their robotic groups to market needs. It helps create a more flexible and quick delivery system. The demand for delivery robots is growing quickly because of the need to be environmentally friendly. With more focus on green solutions, electric-driven and energy-saving robots are becoming popular. These nature-friendly designs match worldwide efforts to cut down carbon emissions and support eco-logistics. As more businesses and people care about protecting the environment, delivery robots that save energy while causing little damage to nature are likely going to be used even more. People working together in the same industry are helping to make market moves. E-commerce websites, delivery companies and technology businesses are working together to make complete solutions that all fit well. The goal of these partnerships is to bring together the abilities of various groups. They try to use e-commerce company skills for managing stock, shipping firms' knowledge about distribution and technology companies’ expertise in robotics and automation.

Leave a Comment