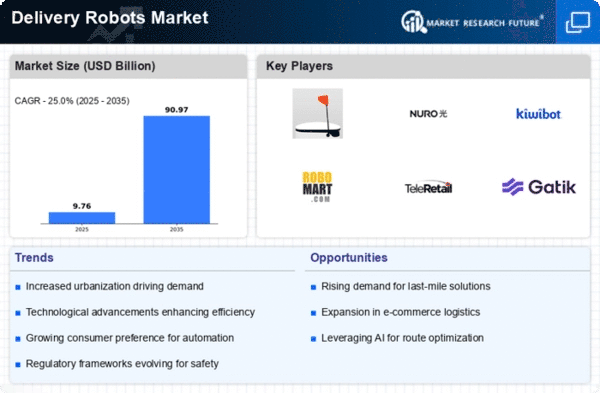

Market Share

Delivery Robots Market Share Analysis

In the Delivery Robots Market, companies use different strategies to get a big part of it and be strong in competition. These tactics are very important for how this market looks. A common method is using tech separation. Businesses want to make their delivery robots special by adding things like new sensors, better computer skills and improved ways of getting around. Companies try to get customers by giving robots advanced tech. This makes them stand out in the market as leaders for new ideas. Working together and forming key alliances also help a lot in getting the biggest share of the market. When delivery robot makers team up with online shopping sites, shipping firms or tech suppliers they can boost their network and easily fit in the current supply chain. These teams make the most of each group's skills. This makes systems that use delivery robots better and more efficient overall. Businesses choose to join forces with important people in their field. They do this so they can benefit from shared things like knowledge, skills and better chances of making more money. Another big idea for robots is making them custom and adaptable. Businesses that offer delivery robots with changeable and personalized options help businesses in various fields meet their unique needs. This method lets people pick or change robots to suit their needs, be it delivering food, moving packages or getting medical stuff. The skill to change for different ways it's used makes businesses flexible problem solvers. They grow their market by meeting many customer needs. A key way to grow your business is by expanding into new areas. This can help you get a better position in the market. Firms want to make a big impact in important areas with lots of need for delivery robot services. By carefully picking what customers they want and growing their reach, businesses can get a bigger part of the market. This helps them find more chances to grow too. This method makes certain that the service is more local and quick to respond, fitting with what's needed in different areas. Cost leadership is a basic way of getting more share in the market. Businesses that work on making production better, cutting down costs for running them and providing robots at low prices can get ahead in competition. By giving low-cost choices without losing quality, businesses put themselves in a good place for companies that want robots to deliver things but don't have too much money. This cheap way can help to make more people use it and grow in the market.

Leave a Comment