March 2024: For example, UberEats declared in March 2024 that in Tokyo, Japan, it would have robot deliveries on account of the growing scarcity of labor and the respect of self-driving delivery robots by the government for April 2023.

December 2023: Cali Group, Miso Robotics and PopID in December 2023 have planned to introduce a fully autonomous restaurant called CaliExpress by Flippy in Southern California.

November 2023: Zomato also reported a 29% increase in food delivery orders this November 2023. The demand for food delivery services is being driven by an increasing disposable income within the region, which has led to restaurant delivery robots being deployed into the market place.

June 2023: The Relay2 robot was unveiled by Relay Robotics at the NYU International Hospitality Industry Investment Conference held in June 2023, formerly known as Savioke. It has a gallon capacity of ten gallons (41 liters) per trip, which is twice as much as its previous models.

April 2023: As part of convenience enhancement programs for its students and staff members, the University of Southern Indiana entered into a robotic delivery partnership with KiwiBot and Grubhub in April 2023.

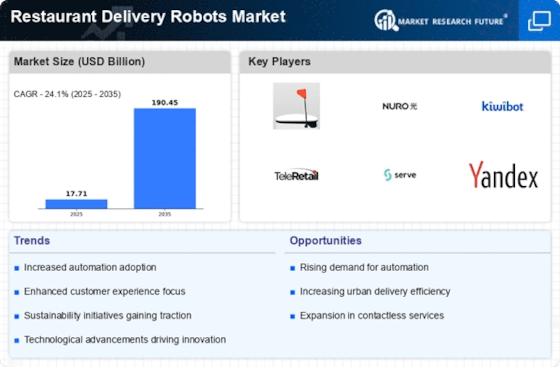

February 2023: This indicates that there will be great opportunities for expansion going forward because companies are increasingly choosing various technological options, such as faster, reliable automated deliveries through the use of drones or other robots. In February 2023 Kiwibot announced raising $10 mln from Kineo Finance, which will be used towards building up its fleet of robotic equipment.

February 2023: Talabat UAE announced the introduction of a food-delivery bot in Dubai through the Integrated Economic Zones Authority in February 2023.

January 2023: GYRO, on January 1st 2023, introduced their latest distribution robot at Consumer Technology Association conference specifically designed hotels/restaurant industry

June 2022: Miso Robotics will put Flippy 2, a robotic arm, through its paces to assess its machine learning and artificial learning abilities. The Wimpy restaurant in Dubai Mall will get the robot arm. This robot arm is quick and can cook a wide variety of foods.

May 2022: Cyan Robotics, doing business as Coco, is bringing 15-minute restaurant delivery to the home delivery robots market. Customers can place an order at a restaurant, and Coco's robot will be driven to the restaurant by a trained "pilot" to pick up the order. The restaurant then enters the order into the delivery bot, which then travels to the customer's home.

May 2022: Relay Robotics, Inc. a new corporation formed by the acquisition of leading robotics developer Savioke announced the completion of a USD 10 million Series A Financing.

May 2022: Chinese start-up Pudu Robotics released PUDU A1, an innovative delivery robot specifically designed for restaurants with a seamless and efficient delivery process.