Market Analysis

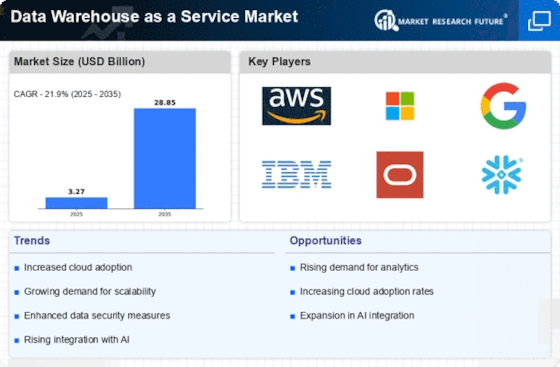

In-depth Analysis of Data Warehouse as a Service Market Industry Landscape

The market dynamics of Data Warehouse as a Service (DWaaS) are going through significant transformations, driven by an intersection of technological advancements, increasing data volumes, and a developing demand for productive data management arrangements. The increased adoption of DWaaS, a cloud-approach to data warehousing in recent years is driven by the scalability, afford ability and agility. Since organizations realize the power of data in guiding informed decision, then a flood has been observed with regard to adoption of DWaaS market.

An important primary driver of the emergence of DWaaS market is the rapid accumulation rate tremendous data produced in organizations. Digital transformations and IoT have led to the creation of enormous amounts of organized and unstructured data held by companies. As a result, this huge flood of information typical for traditional on-premises data warehouses is very difficult in handling it leads organizations to search more adaptable and scalable solutions. DWaaS, being in the cloud enables organizations to grow their data storage and processing compared with change requests easily.

In addition, the factor of cost concerns performs a vital role in market dynamics for DWaaS. The conventional method of deploying and sustaining on-premises information warehouses involves significant upfront capital spending alongside ongoing operating costs. On the contrary, DWaaS relies on a membership based model through which it utilizes pay-as-you method. This not only eliminates the need for big upfront investments but also enables businesses to match costs with their actual usage. DWaaS cost effectiveness makes it an attractive solution for SMEs who can reap the benefits of advanced data analytics without bearing heavy financial loads that come with traditional warehousing.

An intense competitive market is also another significant factor determining the DWaaS dynamics. There is more competition as new players enter the fray. Innovation rises with escalating contest, raising service offerings along the way. To build robust platforms, market leaders invest in research and development consistently to improve their tools with advanced analytics, machine learning and even artificial intelligence features. This technology divides service suppliers and allows end-customers to have more advanced tools for deriving actionable experiences from the information they hold.

Security and compliance issues are among essential factors influencing DWaaS adoption. With the rise in digital threats, organizations tend to focus on data privacy. DWaaS providers are responding by performing rigorous security measures such as encryption, access controls and compliance certifications.

Another factor contributing to the growth of DWaaS market is that it becomes global as a result of business operations worldwide. As the organisations are geographically distributed, we need to access and analyze data from any place. Cloud-based data warehouses facilitate seamless collaboration and data sharing across various districts, supporting a more interconnected and agile business climate.

Leave a Comment