Market Trends

Key Emerging Trends in the Data Warehouse as a Service Market

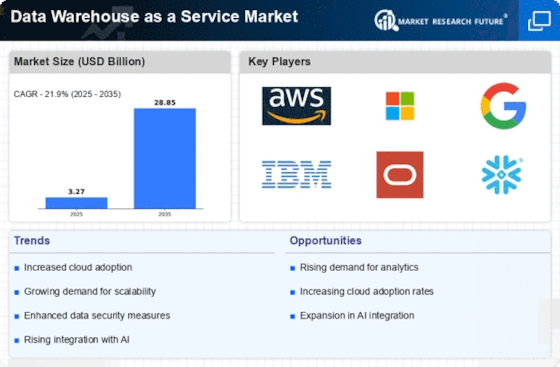

The Data Warehouse as a Service (DWaaS) market has been encountering notable patterns that mirror the developing landscape of data management and analytics. One conspicuous pattern is the developing adoption of cloud-based DWaaS arrangements. Organizations now realize the benefits of moving their data warehouses into a cloud, which allows for scalability, flexibility and is cost-effective. DWaaS providers make it easy for organizations to delegate the problems of infrastructure management, freeing them up to focus on deriving critical insights from their data.

Real-time data processing and analytics is another important trend in the DWaaS market. With the push towards data-driven decision, there has been increased demand for immediate access to agile experiences. DWaaS providers are responding by providing solutions for addressing real-time data and helping organizations respond more quickly to changing market conditions and make smarter decisions quicker.

Further, the adoption of cutting-edge innovations such as artificial intelligence (AI) and machine learning (ML) has transformed what DWaaS solutions offer. These innovations empower data analytics by automating tasks, unmasking hidden patterns and predict future trends. As companies seek further cutting-edge and worldly data skills, DWaaS providers are integrating AI and ML functionalities into their solutions to enable customers advanced analytical abilities without the need for subscriptions in these areas.

Another major trend in the DWaaS market is the focus on data security and compliance. The growing amounts of sensitive information stored and processed lead organizations to concentrate more on the development sturdy security measures as well as adherence with regulatory demands DWaaS providers are responding by strengthening their security packages, adopting encryption protocols and offering tools which allow businesses to comply with regulatory requirements thereby earning customers trust about the safety of data management practices.

Moreover, within the DWaaS market, democratization of data analytics is getting momentum. Historically, the field of data analytics was dominated by researches and analysts who had specific skills. However, DWaaS providers attempt to provide a solution and improve the analytics process by making it more accessible for different corporate persons.

Additionally, the consolidation of data sources is an emerging trend in DWaaS. With the accumulation of data from different channels and platforms, there is a need for an integrated and hybrid centralized giant database. DWaaS models allow process to connect different data sources, providing a holistic view of business operations. This consolidation streamlines data management as well as enhances the effectiveness of analytics by eliminating storehouses and encouraging an exhaustive understanding of the business landscape.

Leave a Comment