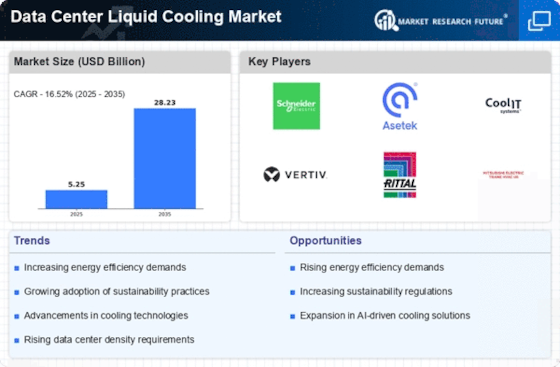

Growing Data Center Density

The Data Center Liquid Cooling Market is influenced by the increasing density of data centers. As organizations consolidate their IT infrastructure, the number of servers per rack continues to rise, leading to higher heat generation. Traditional cooling methods often struggle to manage this heat effectively, resulting in potential equipment failures and reduced operational efficiency. Liquid cooling systems, with their ability to manage higher thermal loads, are becoming essential in modern data center designs. Reports suggest that the average power density in data centers is expected to increase, necessitating advanced cooling solutions. This trend underscores the importance of liquid cooling technologies in maintaining optimal performance and reliability within the Data Center Liquid Cooling Market.

Regulatory Pressure for Energy Efficiency

The Data Center Liquid Cooling Market is also shaped by increasing regulatory pressure for energy efficiency. Governments and regulatory bodies are implementing stringent energy efficiency standards to reduce carbon footprints and promote sustainable practices. Liquid cooling systems are often more energy-efficient than traditional air cooling methods, as they require less energy to operate and can significantly lower cooling costs. As organizations strive to comply with these regulations, the adoption of liquid cooling technologies is likely to rise. This shift not only aligns with regulatory requirements but also enhances the overall sustainability of data center operations, thereby driving growth in the Data Center Liquid Cooling Market.

Rising Demand for High-Performance Computing

The Data Center Liquid Cooling Market is experiencing a surge in demand driven by the increasing need for high-performance computing (HPC) applications. As organizations seek to enhance their computational capabilities, the thermal management of data centers becomes critical. Liquid cooling solutions offer superior heat dissipation compared to traditional air cooling methods, enabling data centers to operate at higher performance levels. According to recent estimates, the HPC market is projected to grow significantly, which in turn fuels the demand for efficient cooling solutions. This trend indicates that liquid cooling technologies are likely to play a pivotal role in supporting the evolving needs of HPC environments, thereby propelling the Data Center Liquid Cooling Market forward.

Increased Focus on Sustainability Initiatives

The Data Center Liquid Cooling Market is increasingly influenced by a heightened focus on sustainability initiatives. Organizations are recognizing the importance of reducing their environmental impact and are actively seeking solutions that align with their sustainability goals. Liquid cooling systems, which typically consume less energy and produce lower greenhouse gas emissions compared to traditional cooling methods, are becoming a preferred choice. As companies commit to achieving net-zero emissions and other sustainability targets, the demand for energy-efficient cooling solutions is likely to grow. This trend indicates that the Data Center Liquid Cooling Market is poised for expansion as organizations prioritize environmentally friendly practices in their data center operations.

Technological Advancements in Cooling Solutions

The Data Center Liquid Cooling Market is benefiting from rapid technological advancements in cooling solutions. Innovations such as direct-to-chip cooling and immersion cooling are revolutionizing the way heat is managed in data centers. These advanced liquid cooling technologies offer improved thermal performance and energy efficiency, making them attractive options for data center operators. As technology continues to evolve, the integration of smart monitoring systems and predictive analytics is expected to enhance the effectiveness of liquid cooling solutions. This ongoing innovation suggests that the Data Center Liquid Cooling Market will continue to expand as organizations seek to leverage cutting-edge technologies for optimal cooling performance.