Regulatory Standards and Compliance

The Concrete Cooling Market is increasingly shaped by regulatory standards and compliance requirements. Governments and regulatory bodies are implementing stricter guidelines to ensure the quality and safety of construction materials, including concrete. These regulations often mandate the use of cooling techniques to prevent issues such as thermal cracking and to enhance the overall performance of concrete. As compliance becomes a critical factor for construction companies, the demand for concrete cooling solutions is expected to rise. This trend is particularly relevant in regions with established building codes that emphasize the importance of proper curing practices. Therefore, the Concrete Cooling Market is likely to see growth as companies adapt to meet these regulatory demands.

Growing Awareness of Quality Control

The Concrete Cooling Market is experiencing heightened awareness regarding quality control in construction projects. As stakeholders recognize the importance of maintaining optimal curing conditions for concrete, the demand for cooling solutions is on the rise. This trend is particularly pronounced in large-scale projects where the quality of concrete directly impacts structural integrity and longevity. Industry standards and best practices are evolving, with many companies adopting stringent quality control measures that include the use of concrete cooling systems. This shift is expected to drive market growth, as firms prioritize the durability and performance of their concrete structures. Consequently, the Concrete Cooling Market is likely to expand as quality assurance becomes a focal point in construction.

Increasing Infrastructure Development

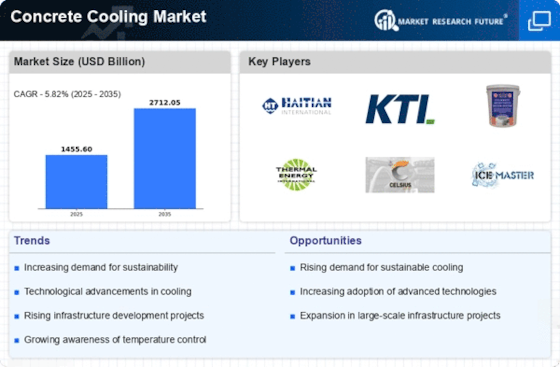

The Concrete Cooling Market is experiencing a surge in demand due to the rapid expansion of infrastructure projects worldwide. Governments and private sectors are investing heavily in roads, bridges, and commercial buildings, which necessitate the use of concrete cooling solutions to ensure optimal curing conditions. This trend is particularly evident in regions where high temperatures can adversely affect concrete quality. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years, further driving the need for effective concrete cooling methods. As infrastructure development continues to rise, the Concrete Cooling Market is likely to benefit significantly from this momentum.

Rising Temperatures and Climate Change

The Concrete Cooling Market is increasingly influenced by rising temperatures attributed to climate change. As average temperatures continue to climb, the risk of thermal cracking in concrete during the curing process escalates. This phenomenon necessitates the implementation of cooling techniques to maintain the integrity and durability of concrete structures. The demand for concrete cooling solutions is expected to grow as construction companies seek to mitigate the adverse effects of heat on concrete performance. Furthermore, studies indicate that regions experiencing extreme heat may see a 20% increase in the need for cooling solutions in the coming years. Thus, the Concrete Cooling Market is poised to expand in response to these climatic challenges.

Technological Innovations in Cooling Techniques

The Concrete Cooling Market is benefiting from ongoing technological innovations that enhance cooling techniques. Advancements in equipment and methods, such as the use of liquid nitrogen and chilled water systems, are improving the efficiency and effectiveness of concrete cooling processes. These innovations not only reduce the time required for cooling but also minimize the risk of defects in cured concrete. The market is witnessing a shift towards more automated and precise cooling solutions, which can lead to cost savings and improved project timelines. As these technologies become more accessible, the Concrete Cooling Market is likely to see increased adoption among construction firms aiming for higher quality standards.