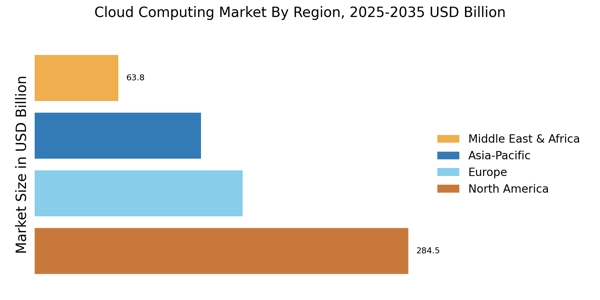

Key cloud computing industry trends include increased hybrid cloud adoption and integration of AI-driven analytics. Strong cloud computing market growth is driven by rising adoption of scalable IT infrastructure and digital transformation initiatives. The cloud computing outlook remains highly positive, with sustained demand across enterprises and government sectors.

The Cloud Computing Market is currently experiencing a transformative phase characterized by rapid advancements in technology and evolving consumer demands. Organizations are increasingly adopting cloud solutions to enhance operational efficiency, reduce costs, and improve scalability. This shift is driven by the need for businesses to remain competitive in a digital-first environment. This cloud computing report provides in-depth analysis of market size, trends, segmentation, and competitive landscape through 2035. The cloud computing industry is undergoing rapid transformation due to advancements in AI, automation, and hybrid cloud architectures.

As enterprises migrate to cloud platforms, they are discovering the benefits of flexibility and accessibility, which are essential for modern business operations. Furthermore, the integration of artificial intelligence and machine learning into cloud services is reshaping how data is processed and analyzed, leading to more informed decision-making. In addition, the Cloud Computing Market is witnessing a growing emphasis on security and compliance. As data breaches and cyber threats become more prevalent, organizations are prioritizing secure cloud solutions that protect sensitive information. This trend is prompting cloud service providers to enhance their security measures and offer more robust compliance frameworks. Overall, the Cloud Computing Market appears poised for continued growth, driven by innovation, security enhancements, and the increasing reliance on digital infrastructure across various sectors.

Accelerated cloud computing industry growth is observed across BFSI, healthcare, retail, and manufacturing sectors. According to cloud computing industry statistics, the market is expected to grow at a CAGR of 16.04% during 2025–2035. The role of cloud computing in Industry 4.0 is critical, enabling real-time data analytics, automation, and smart manufacturing. Business cloud computing enables organizations to improve agility, reduce IT costs, and accelerate innovation. Modern enterprises are transforming operations by running core business processes with cloud computing technologies.

Increased Adoption of Hybrid Cloud Solutions

Organizations are increasingly gravitating towards hybrid cloud models, which combine public and private cloud environments. This approach offers flexibility, allowing businesses to optimize their resources based on specific needs. By leveraging both types of clouds, companies can enhance their operational efficiency while maintaining control over sensitive data.

Focus on Cloud Security and Compliance

As cyber threats escalate, there is a heightened focus on security within the Cloud Computing Market. Organizations are prioritizing secure cloud solutions that ensure data protection and compliance with regulations. This trend is driving cloud service providers to enhance their security protocols and offer comprehensive compliance frameworks.

Integration of Artificial Intelligence in Cloud Services

The integration of artificial intelligence into cloud services is transforming data management and analytics. This trend enables organizations to harness advanced algorithms for better insights and decision-making. As AI capabilities continue to evolve, they are likely to enhance the overall functionality and appeal of cloud solutions.