Expansion of Industrial Sectors

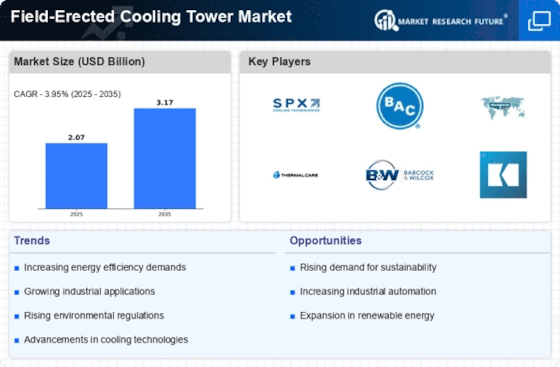

The expansion of industrial sectors, particularly in emerging economies, seems to significantly influence the Field-Erected Cooling Tower Market. Industries such as petrochemicals, pharmaceuticals, and food processing are experiencing robust growth, necessitating efficient cooling solutions. For instance, the petrochemical sector is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years, which could lead to increased demand for field-erected cooling towers. This expansion not only drives the need for larger cooling systems but also encourages innovation in design and technology, thereby enhancing the overall market landscape.

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency within various industries appears to be a primary driver for the Field-Erected Cooling Tower Market. As organizations strive to reduce operational costs and minimize environmental impact, the demand for cooling solutions that optimize energy consumption is likely to rise. According to recent data, energy-efficient cooling towers can reduce energy usage by up to 30%, making them an attractive option for industries such as power generation and manufacturing. This trend is further supported by regulatory frameworks that encourage the adoption of energy-efficient technologies, thereby propelling the growth of the Field-Erected Cooling Tower Market.

Growing Focus on Sustainability Practices

The growing focus on sustainability practices across various sectors is emerging as a significant driver for the Field-Erected Cooling Tower Market. Companies are increasingly prioritizing sustainable operations, which includes the adoption of cooling systems that minimize environmental impact. The demand for cooling towers that utilize renewable energy sources or have lower water consumption rates is on the rise. This trend is supported by a shift in consumer preferences towards environmentally friendly products and services. As sustainability becomes a core business strategy, the Field-Erected Cooling Tower Market is likely to witness increased investment in innovative cooling technologies that align with these practices.

Technological Innovations in Cooling Solutions

Technological innovations in cooling solutions are likely to play a pivotal role in shaping the Field-Erected Cooling Tower Market. Advancements such as the integration of IoT and smart technologies enable real-time monitoring and optimization of cooling processes. These innovations can lead to improved operational efficiency and reduced maintenance costs. Furthermore, the introduction of hybrid cooling systems, which combine wet and dry cooling methods, appears to be gaining traction. This trend is indicative of a broader shift towards more sophisticated cooling solutions that cater to the evolving needs of various industries, thereby fostering growth in the Field-Erected Cooling Tower Market.

Regulatory Compliance and Environmental Standards

Regulatory compliance and stringent environmental standards are increasingly influencing the Field-Erected Cooling Tower Market. Governments worldwide are implementing regulations aimed at reducing water consumption and minimizing thermal pollution. As a result, industries are compelled to adopt cooling technologies that meet these standards. The market for cooling towers that utilize closed-loop systems or advanced water treatment technologies is expected to expand as companies seek to comply with these regulations. This shift not only enhances the sustainability of operations but also drives innovation within the Field-Erected Cooling Tower Market, as manufacturers develop solutions that align with environmental goals.