Rising Demand for Data Centers

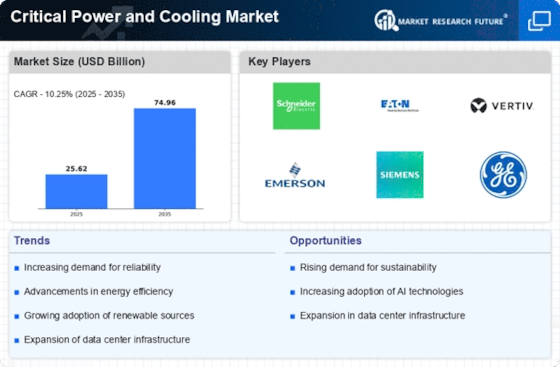

The increasing reliance on digital services and cloud computing has led to a surge in the establishment of data centers. This trend is expected to drive the Critical Power and Cooling Market as data centers require robust power and cooling solutions to maintain operational efficiency. According to recent estimates, the data center market is projected to grow at a compound annual growth rate of over 10%, necessitating advanced critical power and cooling systems. As organizations expand their digital infrastructure, the demand for reliable power supply and effective cooling mechanisms becomes paramount, thereby propelling the growth of the Critical Power and Cooling Market.

Regulatory Compliance and Standards

Stringent regulations regarding energy consumption and emissions are influencing the Critical Power and Cooling Market. Governments and regulatory bodies are increasingly mandating compliance with energy efficiency standards, which compels organizations to invest in advanced power and cooling solutions. For instance, the implementation of energy efficiency regulations can lead to a reduction in operational costs by up to 30%. This regulatory landscape not only drives innovation in cooling technologies but also enhances the demand for critical power systems that meet these standards, thereby fostering growth in the Critical Power and Cooling Market.

Technological Advancements in Power Systems

Innovations in power management technologies are reshaping the Critical Power and Cooling Market. The advent of smart grids, energy storage solutions, and advanced monitoring systems enhances the reliability and efficiency of power supply. These technologies enable organizations to optimize energy usage and reduce downtime, which is crucial for mission-critical operations. The integration of artificial intelligence and machine learning in power management systems is also gaining traction, potentially leading to more efficient cooling solutions. As these technologies evolve, they are likely to create new opportunities within the Critical Power and Cooling Market.

Expansion of Telecommunications Infrastructure

The rapid expansion of telecommunications infrastructure is significantly impacting the Critical Power and Cooling Market. With the proliferation of 5G networks and the increasing number of connected devices, there is a heightened demand for reliable power and cooling solutions to support this infrastructure. Telecommunications companies are investing heavily in new facilities and upgrades to existing sites, which necessitates advanced critical power and cooling systems. This expansion is projected to contribute to a substantial increase in market size, as the need for efficient power management and cooling solutions becomes more pronounced in the Critical Power and Cooling Market.

Increased Focus on Disaster Recovery Solutions

The growing awareness of the need for disaster recovery and business continuity planning is driving the Critical Power and Cooling Market. Organizations are increasingly investing in backup power systems and cooling solutions to ensure operational resilience during power outages or equipment failures. This trend is particularly evident in sectors such as finance, healthcare, and telecommunications, where uninterrupted service is critical. The market for uninterruptible power supplies (UPS) is expected to witness substantial growth, reflecting the heightened emphasis on disaster recovery strategies within the Critical Power and Cooling Market.