Rising Demand for Clean Energy Solutions

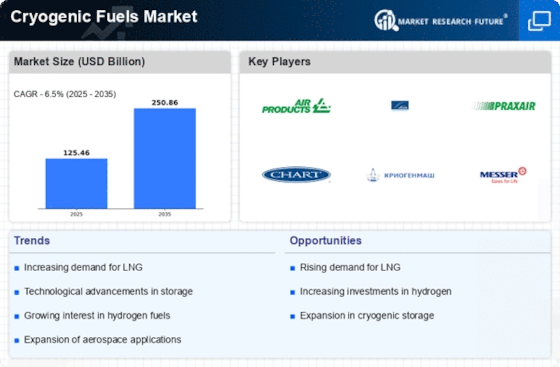

The Cryogenic Fuels Market is witnessing a growing demand for clean energy solutions, driven by the global shift towards sustainable energy sources. As nations strive to reduce greenhouse gas emissions, cryogenic fuels, particularly hydrogen and liquefied natural gas (LNG), are gaining traction as viable alternatives to traditional fossil fuels. The International Energy Agency has indicated that the use of LNG is projected to increase significantly, with a compound annual growth rate of around 5% in the coming years. This trend is likely to bolster the Cryogenic Fuels Market, as industries and governments invest in infrastructure to support the adoption of cleaner fuels. The transition to cryogenic fuels not only aligns with environmental goals but also offers economic benefits, potentially leading to increased investments in the sector.

Expansion of Aerospace and Space Exploration

The Cryogenic Fuels Market is significantly influenced by the expansion of aerospace and space exploration activities. The increasing number of space missions and advancements in rocket technology necessitate the use of cryogenic fuels, such as liquid oxygen and liquid hydrogen, which are essential for propulsion systems. Major space agencies and private companies are investing heavily in developing reusable launch systems that rely on cryogenic fuels for efficiency and performance. According to industry reports, the space launch market is expected to grow substantially, with projections indicating a market value exceeding several billion dollars by the end of the decade. This growth is likely to create substantial opportunities within the Cryogenic Fuels Market, as demand for high-performance fuels continues to rise.

Technological Innovations in Cryogenic Fuels

The Cryogenic Fuels Market is experiencing a surge in technological innovations that enhance the efficiency and safety of cryogenic fuel production and storage. Advanced cryogenic technologies, such as improved insulation materials and innovative liquefaction processes, are being developed to minimize energy consumption and reduce operational costs. For instance, the introduction of high-efficiency cryogenic pumps and compressors is likely to streamline the supply chain, making cryogenic fuels more accessible. Furthermore, the integration of automation and digital monitoring systems in cryogenic facilities is expected to improve operational reliability. As a result, these technological advancements are anticipated to drive growth in the Cryogenic Fuels Market, potentially increasing market size by a notable percentage over the next few years.

Government Initiatives and Regulatory Support

The Cryogenic Fuels Market is being propelled by various government initiatives and regulatory support aimed at promoting cleaner energy solutions. Many governments are implementing policies that encourage the adoption of cryogenic fuels, particularly in transportation and energy sectors. Incentives such as tax breaks, subsidies, and research grants are being offered to companies that invest in cryogenic fuel technologies. Additionally, regulatory frameworks are evolving to facilitate the safe handling and transportation of cryogenic fuels, thereby enhancing market confidence. As these initiatives gain momentum, they are likely to stimulate growth in the Cryogenic Fuels Market, fostering innovation and attracting investments that could lead to a more robust market landscape.

Growing Industrial Applications of Cryogenic Fuels

The Cryogenic Fuels Market is benefiting from the growing industrial applications of cryogenic fuels across various sectors. Industries such as manufacturing, healthcare, and food processing are increasingly utilizing cryogenic technologies for applications like metal processing, cryopreservation, and food freezing. The ability of cryogenic fuels to provide ultra-low temperatures is particularly advantageous in these applications, enhancing product quality and operational efficiency. Market analysis suggests that the industrial segment is poised for growth, with an expected increase in demand for cryogenic fuels in sectors that prioritize efficiency and quality. This trend is likely to further solidify the position of the Cryogenic Fuels Market as a critical component of modern industrial processes.