Cryogenic Fuels Size

Cryogenic Fuels Market Growth Projections and Opportunities

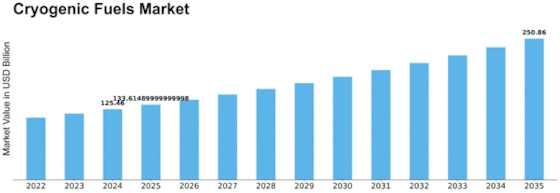

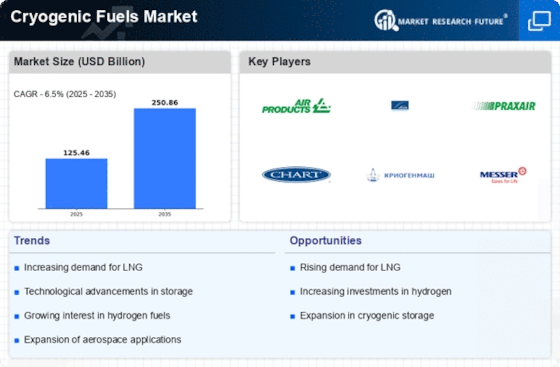

The worldwide cryogenic fuels market is expected to reach USD 194.9 Billion by 2032, growing at 6.50%. The fluid nitrogen fragment had the largest market share in 2022, predicted at 45–65%. The Cryogenic Fuels Market is defined by characteristics that affect cryogenic fuel production, distribution, and use. Cryogenic fuels, which contain LNG and fluid hydrogen, are becoming cleaner and more efficient than traditional fuels. Cryogenic fuels are gaining popularity as fossil fuel wastes are reduced and renewable energy sources are sought.

The global movement toward natural supportability shapes market aspects. Legislators and corporations recognize the need to reduce ozone-damaging chemical outflows and slow environmental change. Cryogenic fuels, which produce less carbon, are crucial to this advancement. Thus, cryogenic fuel synthesis, storage, and transportation are increasingly emphasized.

Mechanical advances also impact the industry. Cryogenic advances have made cryogenic fuels safer and more widely used. More advanced protection materials, high-level liquefaction techniques, and solid stockpiling and transit frameworks have made cryogenic fuels more economically viable. These mechanical advances are spurring innovation and market competition.

The energy sector and global outlook also affect cryogenic fuel markets. As governments seek to diversify their energy sources and reduce their dependence on petroleum, cryogenic fuels become appealing. International factors determine cryogenic fuel asset accessibility and openness, affecting market patterns and exchange aspects.

Administrative systems and government initiatives also shape markets. Cleaner fuels and energy efficiency are being promoted by legislatures worldwide. Sponsorships, charge incentives, and strict discharge norms boost cryogenic fuels sales. Global environmental initiatives and agreements also affect market aspects, creating a strong cryogenic fuels market climate.

Cryogenic fuels have several uses throughout industries. Reception of cryogenic fuels for land and maritime transportation is booming. More ships are using LNG as a greener alternative to marine fuels. The automotive industry is considering fluid hydrogen as a fuel for energy unit electric cars, adding to market factors.

The Cryogenic Fuels Market is shaped by environmental concerns, technological advances, international variables, administrative systems, and supply-demand factors. With market advancements, cryogenic fuels will play a larger role in a more viable energy future. States, enterprises, and exploration institutions must work together to progress, ensure administrative support, and promote the cryogenic fuels market."

Leave a Comment