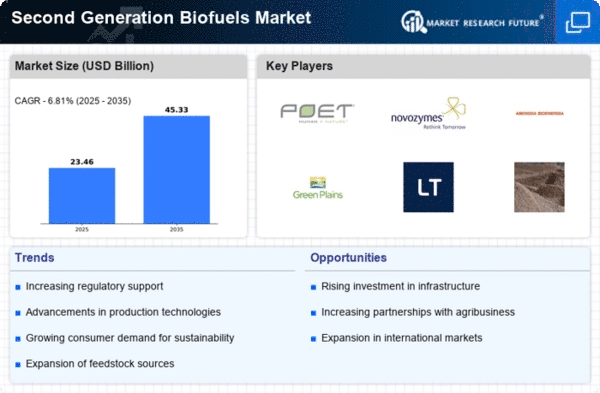

The Second Generation Biofuels Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for sustainable energy solutions and stringent regulatory frameworks aimed at reducing carbon emissions. Key players such as POET LLC (US), Novozymes A/S (DK), and Shell Global (GB) are strategically positioned to leverage their technological advancements and operational efficiencies. POET LLC (US) focuses on innovation in biofuel production processes, while Novozymes A/S (DK) emphasizes enzyme technology to enhance biofuel yield. Shell Global (GB) is actively pursuing partnerships to expand its biofuel portfolio, indicating a collective shift towards collaborative strategies that shape the competitive environment.The market structure appears moderately fragmented, with several players vying for market share through localized manufacturing and optimized supply chains. This fragmentation allows for diverse approaches to production and distribution, enabling companies to cater to regional demands effectively. The influence of key players is significant, as their strategic initiatives often set industry benchmarks, driving others to adapt and innovate in response.

In November POET LLC (US) announced a groundbreaking partnership with a leading agricultural technology firm to enhance the efficiency of feedstock conversion processes. This collaboration is poised to streamline production and reduce costs, thereby reinforcing POET's competitive edge in the biofuels sector. The strategic importance of this partnership lies in its potential to accelerate the adoption of advanced biofuel technologies, positioning POET as a frontrunner in sustainable energy solutions.

In October Novozymes A/S (DK) launched a new enzyme product specifically designed for second-generation biofuels, aimed at improving the conversion rates of lignocellulosic biomass. This innovation not only enhances the efficiency of biofuel production but also aligns with global sustainability goals. The introduction of this product underscores Novozymes' commitment to research and development, which is critical for maintaining its competitive position in a rapidly evolving market.

In September Shell Global (GB) expanded its biofuel production capacity by investing in a new facility in the Netherlands, focusing on the production of advanced biofuels from waste materials. This strategic move reflects Shell's long-term vision of transitioning towards a more sustainable energy portfolio. The facility is expected to significantly increase Shell's output, thereby enhancing its market presence and contributing to the overall growth of the biofuels sector.

As of December current trends in the Second Generation Biofuels Market indicate a strong emphasis on digitalization, sustainability, and the integration of artificial intelligence in production processes. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in achieving innovation and efficiency. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices, reflecting the industry's shift towards a more environmentally conscious future.