Top Industry Leaders in the Cryogenic Fuels Market

*Disclaimer: List of key companies in no particular order

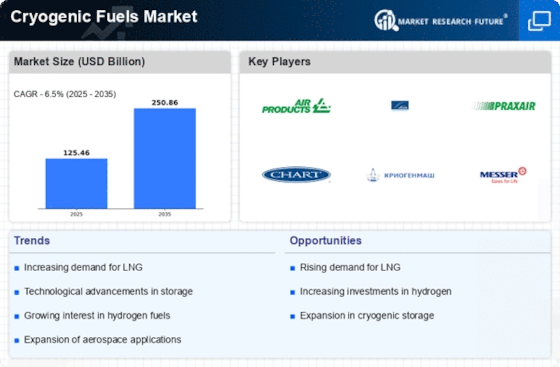

The cryogenic fuels market, dealing with liquids stored at extremely low temperatures (-150°C or lower), is witnessing a remarkable surge in growth. This momentum is fueled by the intersection of environmental imperatives, technological advancements, and escalating demand across various sectors. Navigating this dynamic landscape demands an insightful comprehension of the competitive dynamics in play.

Key Players and Strategies:

The market is dominated by established players such as:

- Air Liquide

- Air Products & Chemicals

- Air Water, Inc.

- Gulf Cryo

- Maine Oxy

- Messer Group GmbH

- Mitsubishi Chemical Holdings (Taiyo Nippon Sanso)

- Narco Inc.

- Linde Plc (Praxair Technology, Inc.)

- SOL Group

These leaders utilize their extensive infrastructure, robust distribution networks, and established customer relationships to uphold their market leadership. Their strategic approaches encompass:

- Product Diversification: Expanding portfolios to encompass emerging options like methane and bio-LNG, going beyond traditional fuels such as LNG and liquid hydrogen.

- Technological Innovation: Investing in research and development (R&D) for efficient production, storage, and transportation of cryogenic fuels, optimizing infrastructure while minimizing energy loss.

- Strategic Partnerships: Collaborating with research institutions, automotive manufacturers, and energy companies to accelerate technology development and market adoption.

- Geographical Expansion: Targeting high-growth markets, especially in Asia-Pacific and Latin America, through acquisitions and joint ventures.

Market Share Analysis:

Several factors influence market share in this dynamic space:

- Type of Cryogenic Fuel: Different fuels cater to specific needs, with liquid hydrogen favored in aerospace applications, while LNG dominates the energy sector.

- End-User Industry: The market serves diverse sectors such as aerospace, healthcare, manufacturing, and energy, each with unique growth trajectories and adoption challenges.

- Regional Variations: Growth is distributed unevenly, with Asia-Pacific expected to witness the fastest expansion.

- Sustainability Factor: The push for green fuels is impacting the market, giving an edge to companies offering bio-LNG or carbon-neutral hydrogen production.

Emerging Trends and Company Strategies:

- Hydrogen Economy: Significant investments are directed towards hydrogen infrastructure, production facilities, and fuel cell technologies in anticipation of a large-scale shift towards hydrogen-powered transportation.

- Renewable Cryogenic Fuels: Bio-LNG and green hydrogen production from renewable sources are gaining traction, attracting investments from companies like Air Liquide and Chart Industries.

- Decentralized Production: Smaller production units closer to demand centers are being explored to address transportation challenges and improve logistics efficiency.

- Digitalization and Optimization: Adoption of AI, cloud computing, and IoT for real-time monitoring, predictive maintenance, and demand forecasting is gaining momentum.

Overall Competitive Scenario:

The cryogenic fuels market is intensely competitive, with established players facing challenges from innovative startups and technology firms. Competition is driving down prices, fostering technological advancements, and diversifying product offerings. Adaptation to the rapidly evolving landscape, investment in R&D, and forging strategic partnerships will be key for future success. Sustainability will be a crucial differentiator, with companies offering greener fuel solutions likely to gain a competitive edge.

In conclusion, the cryogenic fuels market is poised for sustained growth, driven by the convergence of environmental, technological, and industrial forces. Understanding the competitive landscape, key player strategies, and emerging trends is crucial for navigating this dynamic and potentially lucrative market. Companies that innovate, adapt, and prioritize sustainability stand to reap the rewards in this rapidly evolving space.

Industry Developments and Latest Updates:

Air Liquide:

- November 17, 2023: Partnered with Airbus to study the use of liquid hydrogen in long-distance aircraft (Source: Air Liquide press release).

Air Products & Chemicals:

- December 15, 2023: Signed a contract with NASA to supply liquid hydrogen and oxygen for Artemis III mission to the Moon (Source: Air Products press release).

Air Water, Inc.:

- August 10, 2023: Received an order from Toyota for a hydrogen liquefaction plant in Japan (Source: Air Water press release).

Gulf Cryo:

- December 5, 2023: Partnered with Shell to supply liquid hydrogen for a hydrogen refueling station in California, USA (Source: Gulf Cryo press release).

Maine Oxy:

- November 29, 2023: Received a grant from the US Department of Energy to develop a new hydrogen liquefaction technology (Source: Maine Oxy press release).

Messer Group GmbH:

- December 12, 2023: Signed a contract with Airbus to supply liquid hydrogen for a hydrogen-powered A380 aircraft demonstrator (Source: Messer press release).