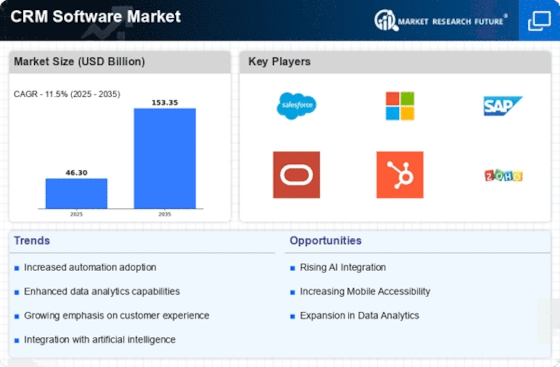

Growing Emphasis on Automation

Automation is becoming a pivotal driver in the CRM Software Market. Organizations are increasingly seeking to automate repetitive tasks such as data entry, lead scoring, and follow-up communications. This emphasis on automation not only enhances operational efficiency but also allows sales and marketing teams to focus on strategic initiatives. Recent data indicates that businesses implementing automation in their CRM processes can experience a productivity boost of up to 40%. As companies strive to optimize their workflows and improve customer interactions, the demand for automated CRM solutions is expected to escalate, thereby fueling growth in the CRM Software Market.

Increased Adoption of Mobile CRM

The proliferation of mobile devices is significantly influencing the CRM Software Market. Companies are increasingly adopting mobile CRM solutions to enable their sales teams to access customer data and manage relationships on-the-go. This trend is particularly pronounced in sectors where field sales are prevalent, as mobile CRM enhances productivity and responsiveness. Recent statistics indicate that mobile CRM adoption has grown by over 30% in the last year alone. This shift not only streamlines operations but also empowers businesses to maintain real-time communication with customers, thereby fostering stronger relationships and driving revenue growth in the CRM Software Market.

Integration of Advanced Analytics

The integration of advanced analytics into CRM systems is transforming the CRM Software Market. Businesses are leveraging data analytics to gain actionable insights into customer behavior, preferences, and trends. This capability allows organizations to make informed decisions and tailor their marketing strategies effectively. Recent studies suggest that companies utilizing analytics within their CRM systems can improve customer retention rates by up to 25%. As organizations increasingly recognize the value of data-driven decision-making, the demand for CRM solutions that incorporate advanced analytics is likely to rise, further propelling growth in the CRM Software Market.

Rising Demand for Customer-Centric Solutions

The CRM Software Market is experiencing a notable surge in demand for customer-centric solutions. Businesses are increasingly recognizing the importance of understanding customer needs and preferences to enhance engagement and loyalty. This shift is driven by the need for personalized experiences, which has become a key differentiator in competitive landscapes. According to recent data, organizations that prioritize customer experience can achieve up to 60% higher profitability. As a result, CRM software providers are innovating to offer advanced features that facilitate deeper customer insights, thereby driving growth in the CRM Software Market.

Expansion of E-commerce and Digital Sales Channels

The expansion of e-commerce and digital sales channels is significantly impacting the CRM Software Market. As more businesses transition to online platforms, the need for robust CRM solutions that can manage digital customer interactions becomes paramount. This trend is evidenced by the fact that e-commerce sales have seen a consistent increase, with projections indicating a growth rate of over 15% annually. Consequently, CRM software that integrates seamlessly with e-commerce platforms is in high demand, as it enables businesses to track customer journeys and optimize sales strategies. This shift towards digitalization is likely to continue driving growth in the CRM Software Market.