Regulatory Compliance

Regulatory compliance plays a crucial role in shaping the Closed System Drug Transfer Device Market. Governments and health organizations are implementing stringent guidelines to ensure the safe handling of hazardous drugs. Compliance with these regulations is not only mandatory but also enhances the credibility of healthcare providers. The market is influenced by the need for devices that meet these regulatory standards, which can lead to increased adoption rates. As a result, manufacturers are focusing on developing products that align with these regulations, thereby driving growth in the Closed System Drug Transfer Device Market.

Rising Demand for Safety

The rising demand for safety in healthcare settings is a significant driver for the Closed System Drug Transfer Device Market. Healthcare professionals are increasingly aware of the risks associated with handling hazardous drugs, leading to a greater emphasis on safety protocols. This heightened awareness is prompting hospitals and clinics to invest in closed system devices that minimize the risk of contamination and exposure. Market data indicates that the demand for these devices is expected to rise, with a projected increase in sales by 20% over the next few years. This trend underscores the importance of safety in the Closed System Drug Transfer Device Market.

Technological Innovations

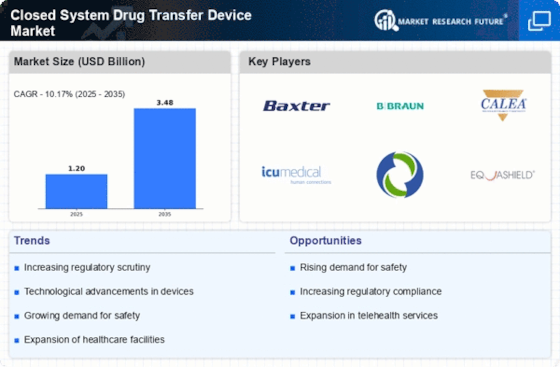

The Closed System Drug Transfer Device Market is experiencing a surge in technological innovations that enhance safety and efficiency in drug handling. Advanced designs, such as needle-free systems and automated transfer devices, are being developed to minimize the risk of exposure to hazardous drugs. These innovations not only improve user experience but also comply with stringent safety regulations. The market is projected to grow at a compound annual growth rate of approximately 15% over the next five years, driven by these advancements. As healthcare facilities increasingly adopt these technologies, the Closed System Drug Transfer Device Market is likely to witness significant expansion.

Expansion of Oncology Treatments

The expansion of oncology treatments is significantly influencing the Closed System Drug Transfer Device Market. As the prevalence of cancer continues to rise, there is an increasing need for safe and effective drug delivery systems. Closed system drug transfer devices are essential in oncology settings, where the handling of cytotoxic drugs poses substantial risks. Market analysts project that the oncology segment will account for a considerable share of the Closed System Drug Transfer Device Market, with growth rates expected to exceed 18% in the coming years. This trend highlights the critical role of these devices in ensuring safe drug administration in oncology.

Increased Focus on Occupational Health

An increased focus on occupational health within healthcare environments is driving the Closed System Drug Transfer Device Market. Healthcare workers are at risk of exposure to hazardous drugs, which can lead to serious health issues. As organizations prioritize the well-being of their staff, there is a growing demand for closed system drug transfer devices that protect healthcare professionals from potential harm. This shift in focus is likely to result in a substantial increase in the adoption of these devices, contributing to the overall growth of the Closed System Drug Transfer Device Market.