Market Share

Closed System Drug Transfer Device Market Share Analysis

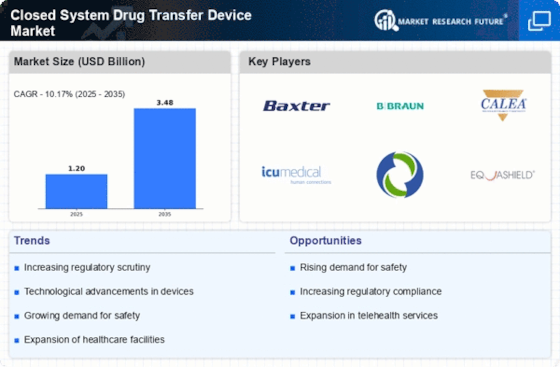

The rise in spending on healthcare buildings around the world is a big chance for the global Closed System Drug Transfer Device (CSTD) market. This is happening because governments and private investors are putting a lot of money into making healthcare systems stronger. With this investment, there is a growing need for advanced safety solutions like CSTDs. The money is being used to make healthcare facilities bigger, more modern, and better, making it easier for CSTDs to be used widely.

This investment is not only making healthcare facilities better but is also creating a good environment for CSTDs to be used more. When people have better access to medical care and when hospitals and clinics have the latest medical technologies, it makes giving medicines more effective and safer. The use of telemedicine and digital health solutions in these upgraded places also increases the need for CSTDs. This ensures that drugs are transferred safely, not just in big hospitals and clinics but also in faraway places where medical help is needed.

Additionally, as healthcare buildings get better, it encourages things like research, education, and efforts to prevent health problems. This opens up opportunities for companies that make and provide CSTDs to give important safety tools and solutions that match the changing needs of healthcare. When the healthcare industry and the development of buildings work together, it creates a connection that doesn't just help patients but also gives opportunities for businesses in the global healthcare market. This collaboration supports new ideas, economic growth, and makes healthcare better all around the world.

In short, the increase in money going into healthcare buildings worldwide is making a big opportunity for the global CSTD market. Governments and private investors are using this money to make healthcare better, and this is creating a good environment for CSTDs to be used more widely. As healthcare gets better, it also helps companies that make safety tools like CSTDs to provide important solutions that match the changing needs of healthcare. When the healthcare industry and building development work together, it doesn't just help patients but also gives opportunities for businesses to grow and make healthcare better globally.

Leave a Comment