Regulatory Support for Health Claims

The Global citicoline as an ingredient Market Industry is positively impacted by regulatory support for health claims associated with Citicoline. Regulatory bodies are increasingly recognizing the potential health benefits of Citicoline, which may facilitate its inclusion in dietary supplements and functional foods. This support can enhance consumer trust and drive market growth, as products containing Citicoline may be perceived as more credible and effective. As regulations evolve to accommodate the growing body of research on Citicoline, manufacturers may find it easier to market their products, thereby contributing to the overall expansion of the market.

Expansion of the Nutraceutical Sector

The Global Citicoline as an ingredient Market Industry is benefiting from the rapid expansion of the nutraceutical sector. As consumers increasingly seek natural and functional ingredients, Citicoline's profile as a cognitive enhancer positions it favorably within this market. The nutraceutical industry is projected to grow significantly, with Citicoline being a key ingredient in various formulations aimed at enhancing mental performance. This trend is indicative of a broader shift towards preventive healthcare, where consumers are more inclined to invest in products that support long-term health. The integration of Citicoline into nutraceuticals is expected to contribute to a robust market trajectory.

Rising Prevalence of Neurological Disorders

The Global Citicoline as an ingredient Market Industry is significantly influenced by the increasing prevalence of neurological disorders. Conditions such as Alzheimer's disease, Parkinson's disease, and stroke are becoming more common, prompting a search for effective management strategies. Citicoline has been studied for its potential benefits in improving cognitive function and recovery in patients with these disorders. This growing health concern is likely to drive the demand for Citicoline-based products, as healthcare providers and patients seek innovative solutions. The market's expansion is anticipated to align with the overall growth of the healthcare sector, further enhancing the visibility of Citicoline.

Growing Demand for Cognitive Health Products

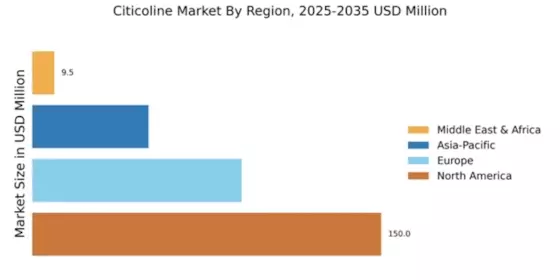

The Global Citicoline as an ingredient Market Industry is experiencing a notable increase in demand for cognitive health products. This trend is driven by a rising awareness of brain health and the importance of cognitive function among consumers. Citicoline, recognized for its potential neuroprotective properties, is increasingly incorporated into dietary supplements and functional foods. As of 2024, the market is valued at approximately 299.1 USD Million, reflecting a growing consumer base that prioritizes mental clarity and focus. This demand is expected to continue, contributing to the projected market growth towards 2035, where it may reach 820.2 USD Million.

Increased Research and Development Activities

The Global Citicoline as an ingredient Market Industry is witnessing a surge in research and development activities aimed at exploring the full potential of Citicoline. Scientific studies are increasingly focusing on its benefits for cognitive health, neuroprotection, and recovery from brain injuries. This heightened research interest is likely to lead to new product formulations and applications, thereby expanding the market. As more evidence emerges regarding the efficacy of Citicoline, manufacturers may be encouraged to innovate and diversify their offerings. This trend not only enhances the credibility of Citicoline but also supports its integration into a wider array of health products.