Innovations in Food Technology

The Pea Protein Ingredients Market is witnessing a wave of innovations in food technology that are enhancing the functionality and applications of pea protein. Advances in processing techniques are enabling manufacturers to create pea protein isolates and concentrates with improved solubility and texture. These innovations are crucial for expanding the use of pea protein in a variety of food products, including dairy alternatives and meat substitutes. Market analysis indicates that the food technology sector is evolving rapidly, with investments in research and development likely to drive further advancements. As a result, the Pea Protein Ingredients Market is expected to benefit from a broader range of applications and improved product performance.

Health Conscious Consumer Trends

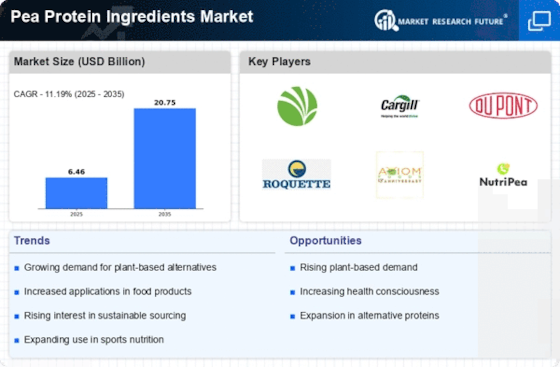

The Pea Protein Ingredients Market is experiencing a notable shift as consumers increasingly prioritize health and wellness. This trend is driven by a growing awareness of the benefits associated with plant-based proteins, particularly among those seeking alternatives to animal-derived products. Research indicates that the demand for protein-rich foods is projected to grow, with plant-based protein consumption expected to rise significantly. As consumers become more health-conscious, they are gravitating towards products that offer nutritional benefits without compromising on taste. This shift is likely to propel the Pea Protein Ingredients Market forward, as manufacturers respond by developing innovative formulations that cater to this health-oriented demographic.

Expansion of Vegan and Vegetarian Diets

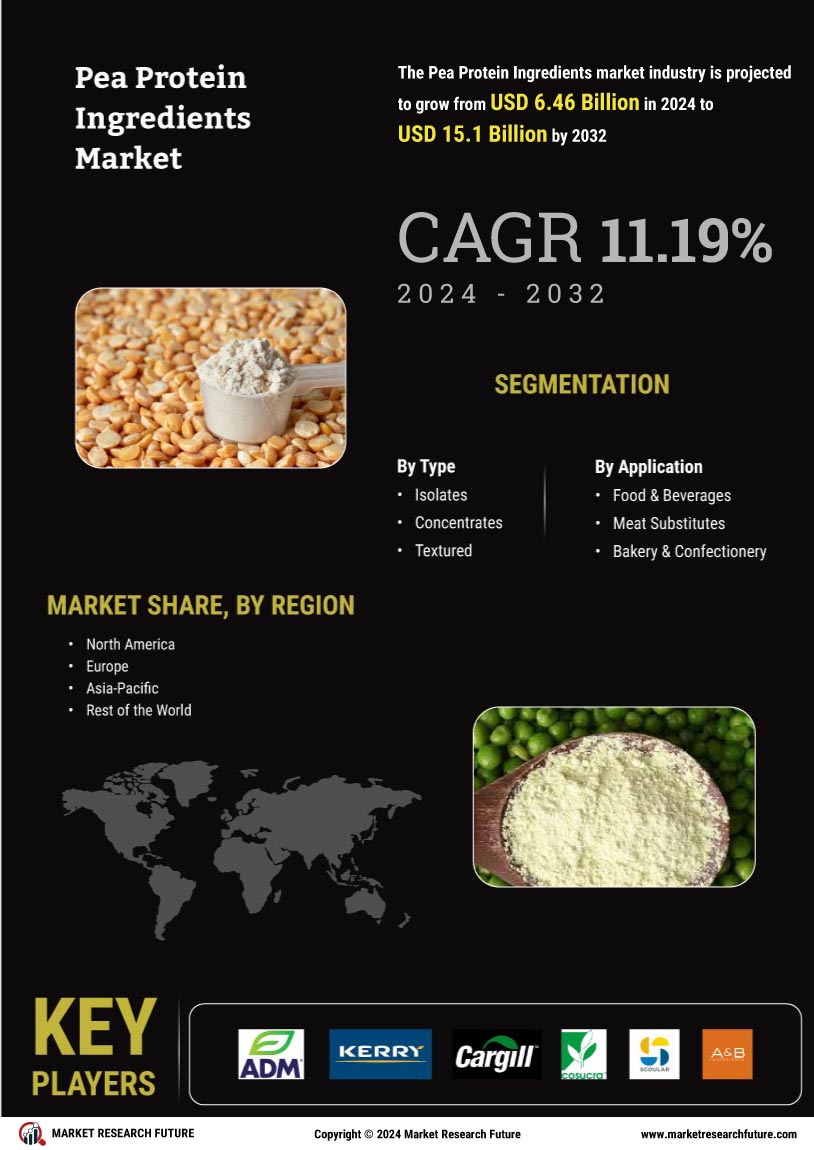

The Pea Protein Ingredients Market is poised for growth due to the increasing adoption of vegan and vegetarian diets. As more individuals choose to eliminate animal products from their diets, the demand for plant-based protein sources has surged. Pea protein, known for its high digestibility and amino acid profile, is becoming a preferred choice among consumers. Market data suggests that the plant-based protein sector is expanding rapidly, with projections indicating a compound annual growth rate that could exceed 10% in the coming years. This trend not only reflects changing dietary preferences but also highlights the potential for pea protein to play a crucial role in meeting the protein needs of a diverse consumer base.

Rising Popularity of Clean Label Products

The Pea Protein Ingredients Market is benefiting from the rising popularity of clean label products. Consumers are increasingly scrutinizing ingredient lists and seeking transparency in food production. This trend has led to a demand for ingredients that are perceived as natural and minimally processed. Pea protein, often marketed as a clean label ingredient, aligns well with these consumer preferences. As manufacturers strive to meet the clean label demand, the Pea Protein Ingredients Market is likely to see an uptick in product offerings that emphasize simplicity and purity. This shift not only caters to consumer desires but also positions pea protein as a versatile ingredient in various applications, from snacks to beverages.

Sustainability and Environmental Concerns

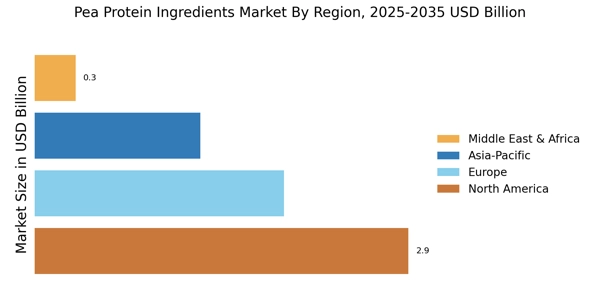

The Pea Protein Ingredients Market is increasingly influenced by sustainability and environmental concerns. As consumers become more aware of the ecological impact of their food choices, there is a growing preference for plant-based proteins that require fewer resources to produce compared to animal proteins. Pea protein, with its lower carbon footprint and water usage, is emerging as a sustainable alternative. Market trends suggest that sustainability is not just a passing fad; it is becoming a core value for many consumers. This shift is likely to drive demand for pea protein ingredients, as manufacturers align their product offerings with the sustainability ethos that resonates with environmentally conscious consumers.