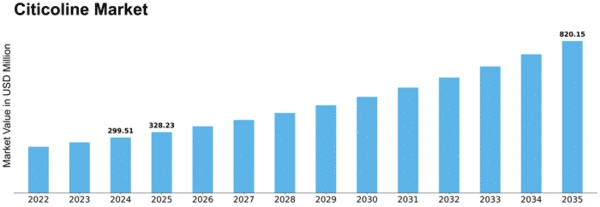

Citicoline As An Ingredient Size

Citicoline as an ingredient Market Growth Projections and Opportunities

The market for citicoline as an ingredient is influenced by several key factors that drive its growth and dynamics. One of the primary drivers of this market is the increasing awareness of cognitive health and brain function among consumers. Citicoline, a naturally occurring compound found in the brain, has gained attention for its potential cognitive enhancement properties. As more people seek ways to improve memory, focus, and overall brain health, the demand for citicoline as an ingredient in dietary supplements and functional foods has grown significantly.

Economic factors also play a significant role in shaping the citicoline market. Fluctuations in disposable income levels impact consumers' purchasing power and their willingness to spend on health and wellness products. During periods of economic uncertainty, consumers may prioritize essential items over discretionary purchases like dietary supplements containing citicoline. Conversely, during economic prosperity, consumers may be more inclined to invest in products that offer potential cognitive benefits, boosting sales in this market segment.

Regulatory policies and standards are another critical factor influencing the citicoline market. Compliance with regulatory requirements, such as labeling regulations and safety standards, is essential for manufacturers to ensure consumer trust and meet legal obligations. Additionally, certifications such as Good Manufacturing Practices (GMP) and third-party quality certifications may influence purchasing decisions, particularly among consumers seeking reassurance of product quality and safety.

Technological advancements also impact the citicoline market, particularly in formulation and delivery technologies. Manufacturers are continually innovating to develop new and improved delivery formats for citicoline supplements, such as capsules, tablets, powders, and liquid formulations. Advanced encapsulation techniques and bioavailability-enhancing technologies can improve the efficacy and absorption of citicoline, enhancing its appeal to consumers seeking maximum benefits.

Competitive dynamics and market competition are significant factors in shaping the citicoline market. Established brands with strong market presence and brand recognition may dominate shelf space and consumer preferences, making it challenging for new entrants to gain traction. However, innovative startups and niche players can disrupt the market with unique formulations and marketing strategies, targeting specific consumer segments seeking cognitive health solutions.

Changing consumer lifestyles and demographics also influence the citicoline market. As the population ages, there is a growing interest in products that support cognitive function and brain health, driving demand for citicoline-containing supplements among older adults. Additionally, lifestyle factors such as stress, poor dietary habits, and increased screen time have led to a rise in demand for cognitive support supplements among younger demographics seeking to optimize mental performance and productivity.

Moreover, scientific research and clinical studies play a crucial role in shaping the citicoline market. As more evidence emerges supporting the efficacy and safety of citicoline for cognitive enhancement, consumer confidence in the ingredient grows, driving adoption and market expansion. Manufacturers often leverage scientific research and clinical data in their marketing efforts to educate consumers about the benefits of citicoline and differentiate their products in a crowded market landscape.

Leave a Comment