Government Initiatives and Funding

Government initiatives and funding aimed at combating chronic kidney disease are pivotal in shaping the Chronic Kidney Disease Market. Various health organizations are allocating resources to enhance research, improve treatment accessibility, and promote awareness campaigns. For instance, funding for kidney disease research has seen a notable increase, which is expected to lead to the development of novel therapies and technologies. Additionally, public health policies that focus on CKD prevention and management are likely to create a more favorable environment for market growth. These initiatives not only support patients but also encourage innovation within the industry, fostering a landscape conducive to advancements in CKD treatment.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is reshaping the Chronic Kidney Disease Market. Healthcare providers are increasingly emphasizing early detection and management of CKD to mitigate its progression. This trend is supported by initiatives aimed at educating the public about risk factors and the importance of regular health screenings. As a result, there is a growing demand for diagnostic tools and monitoring devices that facilitate early intervention. The market for such technologies is expected to expand, driven by the need for effective preventive measures. Furthermore, the integration of preventive strategies into healthcare systems is likely to enhance patient outcomes and reduce the overall burden of CKD, thereby influencing market dynamics.

Advancements in Renal Replacement Therapies

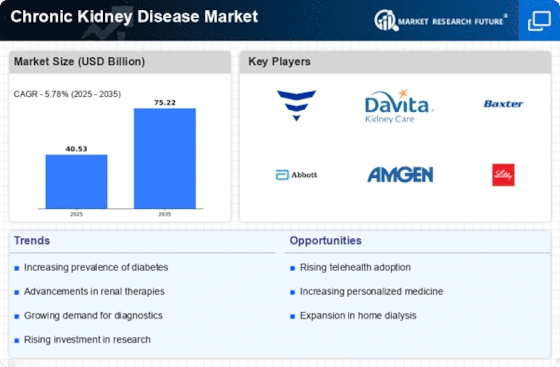

Innovations in renal replacement therapies, including dialysis and kidney transplantation, are significantly influencing the Chronic Kidney Disease Market. The development of more efficient dialysis machines and improved transplantation techniques has enhanced patient outcomes and quality of life. For instance, the introduction of home dialysis options has expanded access to treatment, allowing patients to manage their condition more effectively. The market for renal replacement therapies is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years. This growth is indicative of the increasing investment in research and development aimed at improving renal therapies, which is crucial for addressing the needs of CKD patients.

Rising Prevalence of Chronic Kidney Disease

The increasing incidence of chronic kidney disease (CKD) is a primary driver of the Chronic Kidney Disease Market. According to recent estimates, approximately 10% of the population is affected by CKD, with numbers expected to rise due to factors such as aging populations and the prevalence of diabetes and hypertension. This growing patient base necessitates enhanced treatment options and diagnostic tools, thereby propelling market growth. The Chronic Kidney Disease Market is witnessing a surge in demand for innovative therapies and management solutions, as healthcare systems strive to address the needs of this expanding demographic. As awareness of CKD increases, more individuals are seeking medical attention, further driving the market's expansion.

Growing Demand for Home-Based Care Solutions

The rising demand for home-based care solutions is transforming the Chronic Kidney Disease Market. Patients increasingly prefer receiving care in the comfort of their homes, which has led to a surge in the development of home dialysis systems and telehealth services. This trend is driven by the desire for greater convenience, improved quality of life, and reduced healthcare costs. Market analysts project that the home healthcare segment will experience significant growth, with an expected CAGR of around 7% over the next few years. This shift not only reflects changing patient preferences but also highlights the need for innovative solutions that cater to the unique challenges faced by CKD patients, thereby influencing the overall market landscape.